Lords LB Special Fund V acquired 5.8 hectares of land and several buildings, including Preses Nams, on the left bank of the River Daugava that runs through the Latvian capital, from Latvijas Kugnieciba (Latvian Shipping Company, LASCO), paying €16.8m for it.

This is going to be the largest office space development project in the Baltics and one of first steps of the company's expansion in the region, the Lithuanian company said.

"With consistent growth of our funds' assets, we search for new investment directions. The project in Riga is one of the first steps in expansion of our real estate investments' geography. This is our first commercial real estate development investment outside Lithuania", said Domas Kacinskas, CEO at Lords LB Asset Management.

The assets managed by Lords LB Asset Management have grown from €158 million to over €320 million over the last three years.

The asset was purchased by Lords LB Special Fund V, which aims at investing into real estate projects in Latvia. The fund’s initial size is €20 million and the maximum size is €40 million. The fund will be active for at least eight years and will invest more than €200 million into development of the project. Investments will be carried out over several phases.

As reported, LASCO Investment, a subsidiary of Latvijas Kugnieciba (Latvian Shipping Company), has sold Preses Nams to a company controlled by Lords LB Asset Management in a deal worth €16.8 million.

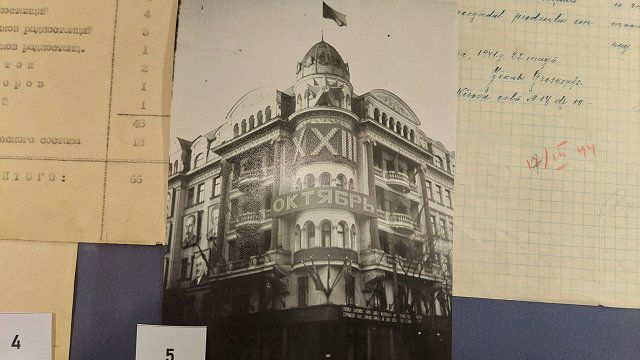

Soviet-built Preses Nams is one of the Latvian capital's highest buildings. It previously housed media organizations, hence its name which translates into English as the House of the Press.

Parts of the largely derelict building currently hold workshops, a carting track, and serve as a laser-tag venue.

Lords LB Asset Management is an investment management company licensed by the Bank of Lithuania that has been providing services to institutional and private investors since 2008. In total, Lords LB Asset Management manages 13 funds, including eight real estate funds, three private equity funds, and two energy and infrastructure funds. Total value of the assets under management of the fund amounted to €310 million at the end of December 2016.