The LETA news agency reported that new Finance Ministry proposals on tax reform will suggest cutting personal income tax to 20%, abolishing the 'solidarity tax' paid by the highest earners in the country, and will retain the microenterprise tax.

Finance Minister Dana Reizniece-Ozola revealed full details at a meeting of the Tripartite Council, which involved employers and unions as well as government.

Reizniece-Ozola said she had analyzed various proposals from the Bank of Latvia, the Latvian Employers Confederation, the Latvian Chamber of Commerce and Industry, the Organization for Economic Cooperation and Development, the World Bank, the Certus thinktank and other organizations in drawing up the ministry's plans and was pleased to draw on all their expertise.

— Finanšu ministrija (@Finmin) February 28, 2017

"The tax system is one of the most important factors in the economy," with effects on everything from exports to demographics, she said.

"Tax reform is needed in order to pursue our agreed national development plan," and to continue the process of convergence with more developed economies in other parts of the EU, the minister said at the meeting.

Brexit would probably reduce the money available from EU sources in future years, making the securing of reliable revenues even more important, she added.

The Finance Ministry and other authors of the proposals agree that there is high labor force tax burden in Latvia, especially for low wage earners. Also, the ministry believes that corporate tax reform is needed.

The Finance Ministry proposes to reform labor taxes, introducing a personal income tax at 20 percent for income of up to €45,000 a year, and a tax rate of 23 percent on income above €45,000 a year.

The minimum wage should be raised to €430 a month, and the solidarity tax on high earners should be abolished.

The ministry proposes to apply 20 percent corporate tax on distributed profit.

The ministry explains that if at the moment a person receives €910.50 a month as a gross wage, it ends up as €641.30 as a net wage, while after the proposed labor tax reform, the net wage would amount to €680.90.

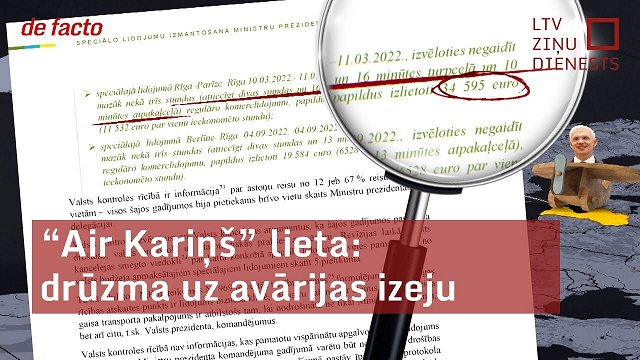

Kādas izmaiņas uzņēmumu ienākumu nodoklī nodokļu reformas ietvaros piedāvā Finanšu ministrija? #nodokļureforma #UIN pic.twitter.com/ZpxduGANQb

— Finanšu ministrija (@Finmin) February 28, 2017

The Finance Ministry has proposed changes in capital tax, setting a 20 percent income tax on distributed profit, and 0 percent tax on reinvested profit.

The value added tax (VAT) should be retained at 21 percent. The ministry wants to start discussions on gradual increases of excise tax.

The ministry has also prepared proposals in relation to microenterprise tax. The ministry proposes to retain the microenterprise tax system, reducing the maximum turnover from the current €100,000 to €40,000 a year.