Written by Joshua Kirschenbaum, the report also includes a handy summary of some of the biggest scandals to have appeared in the non-resident banking sector over the last decade.

- The $20 billion Russian Laundromat

- The $3 billion Azerbaijani Laundromat

- The $1 billion Moldovan bank heist

- The $1 billion Kazakh bank fraud

- The $230 million Russian tax fraud uncovered by Sergei Magnitsky

- The $10 billion Russian “mirror trading” scheme

- The $5.5 billion asset-stripping of Ukraine’s largest bank

- Public corruption involving the transit of natural gas through Ukraine

- Fines against the second- and third-largest non-resident banks, Norvik and Rietumu, for AML failures that allowed their customers to “circumvent international sanctions [against] North Korea”

There is also an assessment of current efforts to clean up the sector and whether they will prove sufficient to regain the trust of Latvia's international partners in general and the United States in particular.

"The United States and the European Union should continue to support those in Latvia who are prepared to bring the non-resident banking business under control once and for all. To get reform right, though, Latvia must proceed in a methodical, thorough manner. There is a real risk that, in a moment of panic followed by a moment of relief, Latvian reformers will unintentionally squander this political opportunity. A lasting solution will require deeply rooted institutional changes, increased enforcement resources, and sustained political commitment to ensure that the dominance of the non-resident banks is eliminated and never renewed," the report says.

"Latvia is in the midst of an evaluation by Moneyval, the anti-money laundering body of the Council of Europe. A negative report could result in referral to the Financial Action Task Force, an inter-governmental organization that sets global AML standards and has the ability to blacklist noncompliant jurisdictions," the report warns.

However, there is also praise for the recent introduction of a law banning banks from doing business with shell companies from offshore jurisdictions.

"Passage of the law is a bold, dramatic gesture. It is the first ban of its kind anywhere in the world, and it is designed to demonstrate to the United States whose side Latvia is on," it says.

Nevertheless, "The ban matters more for its politics and its empowerment of reformers than for its ability to prevent illicit financial activity over the long term. The trick is to prevent the resurrection of an out-of-control banking sector after memories have faded. The non-resident money escaping to friendlier climes today can just as easily reverse its flow once the winds shift tomorrow," the report adds.

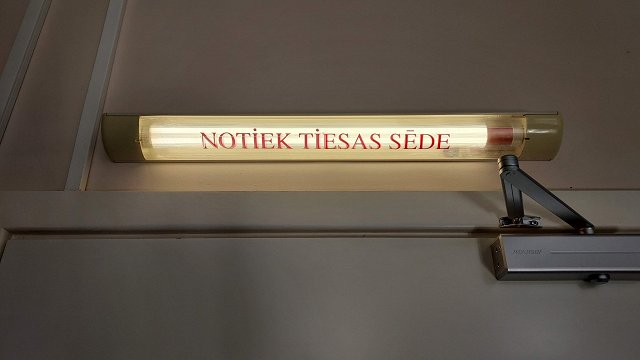

Latvia should also "tackle corruption and inefficiency in the government as a whole and in the judicial system in particular," it recommends.

The report can be read in full and downloaded in PDF format HERE.

The German Marshall Fund of the United States was founded in 1972 as a non-partisan, nonprofit organization through a gift from Germany as thanks to the US for Marshall Plan assistance after the Second World War. It contributes research and analysis on transatlantic issues.