"During March and April the number of such arrangements in the customer base has been shrinking rapidly," FKTK said in a statement, adding that only around 0.5% of accounts in Latvian banks are still suspected shell companies which need to be resolved.

On May 9, amendments to the Law on Prevention of Laundering and Terrorist Financing (NILLTFN Law) entered into force, which obliged market participants to discontinue cooperation with shell companies in Latvia within 60 days.

Shell companies are defined as corporate entities with no real economic activity and economic value, and which do not submit credible financial statements proving otherwise. The 60-day deadline for compliance with this law is July 7, giving banks just a few more days to get shell companies off their books.

FKTK Chairman Peters Putniņš, who is part of a concerted effort by Latvian officials to persuade the international community the long-lasting reputation of the country as a money-laundering hub is no longer justified, said:

"At the moment we can say with certainty that the Latvian banks have taken on this task with a great deal of responsibility, the process is going to be dynamic and will be completed within the set time. The situation improves with each passing day."

As well as the number of accounts, the amount of money held in shell company accounts has decreased markedly, Putniņš said, without giving a precise figure.

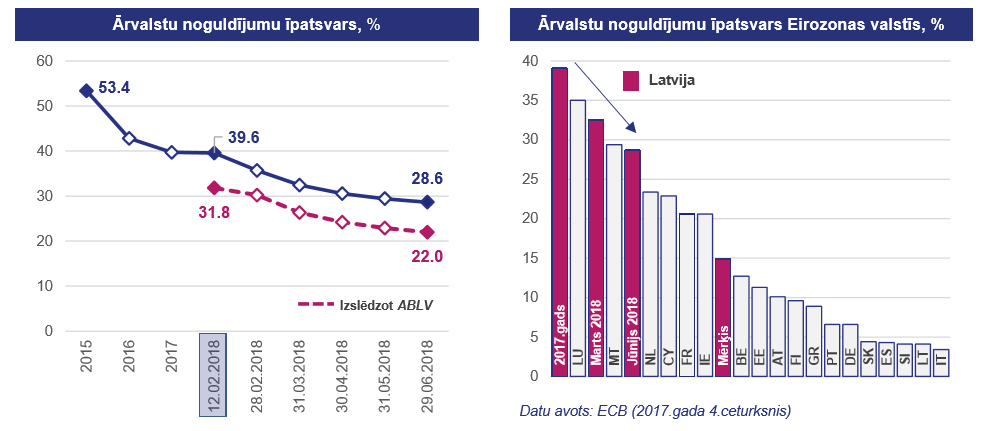

However, the share of foreign customer deposits (including legitimate non-resident deposits as well as shell company deposits) at the end of June was 28%, FKTK said, whereas back in 2015 non-resident deposits outweighed local deposits.

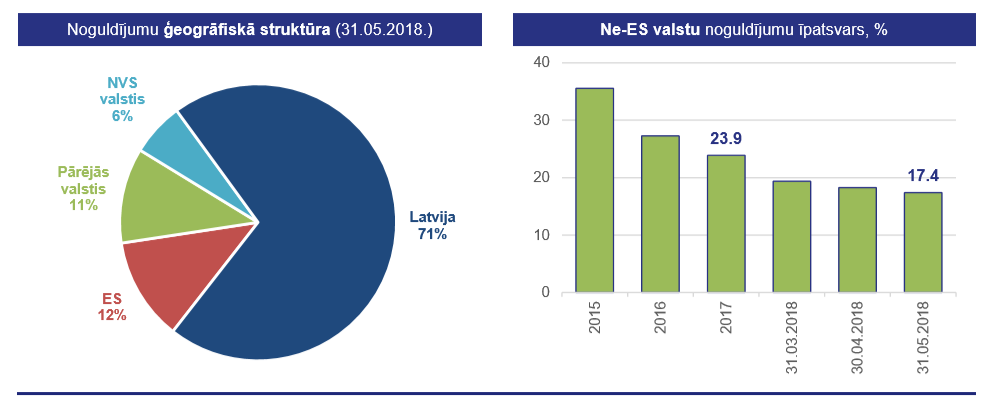

The geographical structure of the deposits now shows that 71% of the Latvia's deposits are local, 12% are from other European Union countries and 11% from third countries, with the amount of deposits from the former CIS countries which are frequently associated with money-laundering activity now at 6%.

Over two years, the outflow of foreign deposits is estimated at over 5 billion euros and according to FKTK forecasts, at the end of this year foreign deposits could amount to about 3.5 billion euros, which would account for abotu 20% of all deposits within Latvian banks.

The release of the information comes as Latvian officials await the imminent release of a MONEYVAL report on the state of anti-money laundering structures in Latvia that could have a major impact on the future shape of the banking sector.