The new edition sheds light on the impact of COVID-19 on businesses’ investment and future employment plans, as well as innovation and digitalisation activities and the impact of climate change and climate investment on EU firms and includes a chapter on Latvia.

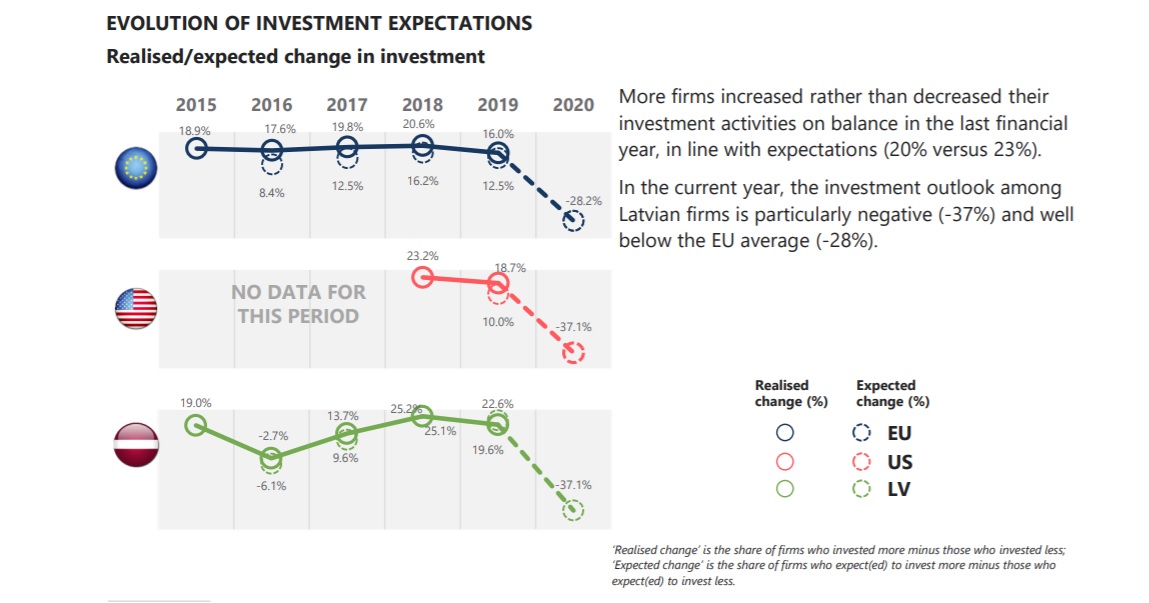

"In the current year, the investment outlook among Latvian firms is particularly negative (-37%) and well below the EU average (-28%)," the report says.

"When considering the impact of COVID-19 on investment, Latvia has a very similar profile to the EU. More than half of firms in Latvia (52%) report that their plans will be broadly the same against the background of COVID-19, in line with the EU average (50%). The share of firms in Latvia which expect to invest less due to the pandemic is 44% while 5% of firms expect to invest more, in line with EU averages (45% and 6% respectively)," the EIB says.

More than a fifth (22%) of firms with investment plans for the current financial year plan to abandon or delay at least some of their investments as a result of COVID-19, well below the EU average (35%). A similar share of firms (24%) expect to continue with at least some of their investment plans with a reduced scale/scope, broadly similar to the EU average (18%). Construction and services sector firms have the lowest share of firms that intend to abandon or delay investment plans due to the pandemic (19% and 16% respectively).

Fewer than one in ten firms (9%) expect a permanent reduction in employment levels as a result of COVID-19. However at the same time firms in Latvia have turned much more pessimistic about the economic climate (down 54 five percentage points to -53%) and the availability of internal finance (down 43 percentage points to -24%) than EIBIS 2019. Almost nine in ten firms consider the availability of skilled staff (88%) and uncertainty about the future (87%) as long term barriers to investment.

"Looking ahead to the next three years, replacing existing buildings, machinery, equipment and IT is the most commonly cited investment priority among firms in Latvia (37%). This in line with EIBIS 2019 (39%) and the EU average (34%). Capacity expansion for existing products and services is the priority for 28% of firms, followed by developing new products/services (23%)," the report suggests.

The full Latvia report goes into considerable detail and is available to read online.