The legal framework has now been launched to allow Rīga to issue bonds with the end goal to finance investment projects. By May 25, the FM has to submit a draft regulation to the Cabinet for the procedures and conditions for issuing municipal bonds of Rīga, according to the government's draft decision.

It is planned to finance investment projects that are in line with the local government development program approved by the State and the implementation of useful and sustainable investments to ensure the autonomous role of the municipality, said FM.

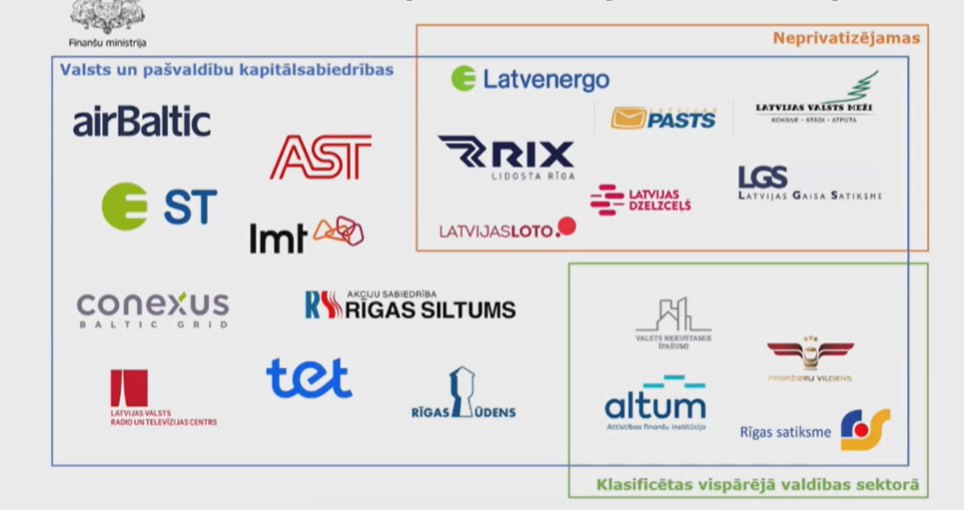

According to Finance Minister Arvils Ašeradens (New Unity), state capital companies that could be potential capital market players are the national airline airBaltic and Conexus Baltic Grid. These companies have already decided to list their bonds on stock exchange, said Ašeradens.

airBaltic's business plan and State aid commitments provide for the possibility to raise funding by issuing bonds or through an initial public offering. Conexus Baltic Grid is expected to participate in the capital market by 2027.

The government will also assess the potential market participation of LMT, Tet, State JSC Sadales tīkls, State JSC Augstsprieguma tīkls, and others, said Ašeradens.

State and local government capital companies

It is expected that the financing of the planned investment projects in the capital market will also be raised by the joint venture Latvenergo and Latvian State Forests, "Latvian Wind Parks", according to the FM report.

The main task with the involvement of state-owned enterprises in the capital market is to increase the capitalization of the stock market. It should be around 9% against GDP by 2027. In 2021, the stock market capitalization in Latvia was only 3% of GDP, while in Lithuania it was 9.3% and in Estonia 17.4%, the report stated.