The 'VAT gap' is an estimate of the overall difference between expected VAT revenue and the amount actually collected.

"EU Member States are losing billions of euros in VAT revenues because of tax fraud and inadequate tax collection systems. The VAT Gap provides an estimate of the VAT revenue loss due to tax fraud, tax evasion, tax avoidance and optimisation practices, bankruptcies, financial insolvencies, as well as miscalculations and administrative errors. Other circumstances that could have an impact on the size of the VAT Gap include economic developments and the quality of national statistics," the EC said by way of preamble.

The assessment was carried out for a five-year period from 2016 to 2020, as well as a so-called 'quick' assessment of the VAT gap for 2021. Despite the negative impact of Covid-19 on the growth of the European economy, according to the published data, in 2020, in comparison with 2019, the VAT gap in the EU member states as a whole was seen to decrease from 11.0% to 9.1% during the year.

In 2020, the trend of reducing the VAT gap continued in Latvia as well, ranking it in 5th place among the EU member states with the most efficient VAT collection system. According to the assessment made by the EC, Latvia's VAT gap in 2020 was only 3.6%, which was 3.6 percentage points less than a year earlier. According to this creator, Latvia is surpassed only by the Netherlands (2.8%), Sweden (2.0%), Estonia (1.8%) and Finland (1.3%).

The EC rapid assessment of VAT for 2021 shows that the VAT gap in Latvia continued its decreasing trend last year, although not at such a fast pace as previously, decreasing by another 0.2 percentage points. The rapid assessment follows a simplified methodology, but allows for an initial assessment for the year prior to the year of full publication of the report.

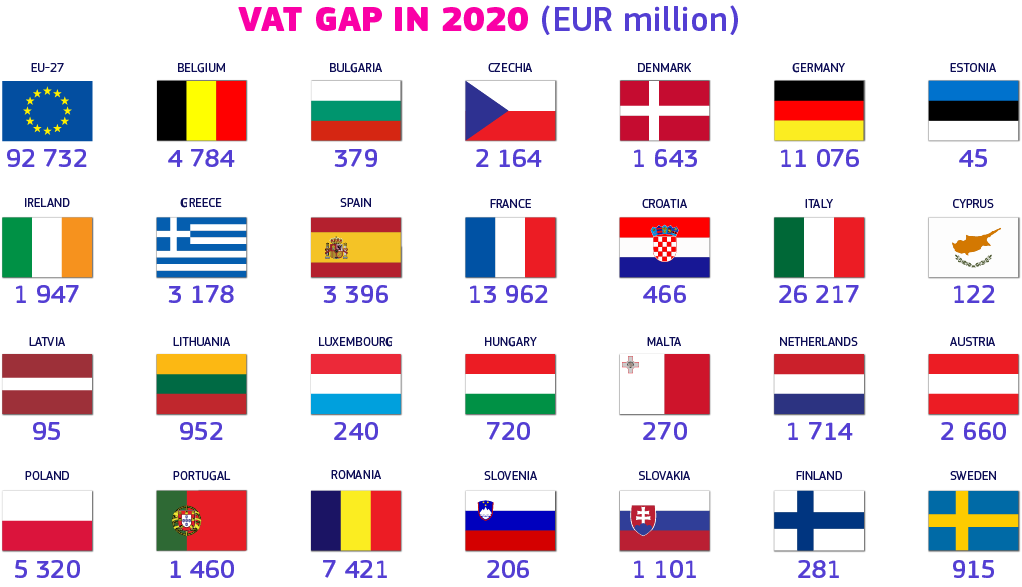

"In 2020, Romania recorded the highest national VAT compliance gap with 35.7% of VAT revenues going missing in 2020, followed by Malta (24.1%) and Italy (20.8%). The smallest gaps were observed in Finland (1.3%), Estonia (1.8%), and Sweden (2.0%). In absolute terms, the highest VAT compliance gaps were recorded in Italy (€26.2 billion) and France (€14 billion)," said the EC.

Across the EU, the absolute year-over-year change in the VAT Gap was 2 percentage points. Overall, the VAT Gap share decreased in 20 Member States. The most significant decreases in the VAT Gap occurred in Hungary, Germany and the Netherlands (between -4.7 and -4.1 percentage points in these three countries). In addition to Germany and the Netherlands, Spain and Latvia succeeded in limiting the loss in VAT revenues to less than 5% of the VAT due. On the other hand, the biggest increases in the VAT Gap were observed in Croatia (+6.0 percentage points) and Cyprus (+5.0 percentage points).