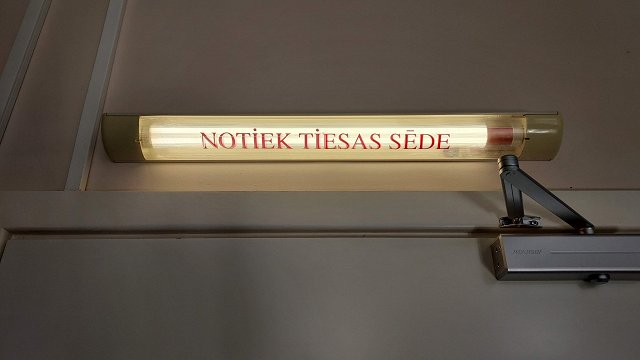

The Rīga Regional Court Criminal Panel reviewed the appeal handed in by the Head Prosecutor for the Investigation of Financial and Economic Crimes regarding the first sentencing, upheld the appeal and sentenced two persons to time behind bars. One person, a board member, was charged with tax evasion, and the other, a company employee, was charged with abetting tax evasion. Neither individual was named.

From 2011 to 2012 the pair faked business transactions and the necessary documents, including creating fake checks in the business' name to decrease the amount of taxes owed. In total the state lost out on 104,458 euros in taxes, including 76,459 euros in VAT and 19,678 in corporate tax.

As previously reported in 2019, Latvia's tax system won a high position in a ranking of the revenue systems of developed countries, but there has been a widespread belief within society that the consequences of non-payment have been mild enough to make tax evasion seem like a worthwhile gamble in some cases. The convictions may send a message that this is no longer the case.

The Tax Foundation’s International Tax Competitiveness Index (ITCI) measures the degree to which the 36 Organizaion for Economic Cooperation and Development (OECD) countries’ tax systems promote competitiveness through low tax burdens on business investment and neutrality through a well-structured tax code. The ITCI considers more than 40 variables across five categories: Corporate Taxes, Individual Taxes, Consumption Taxes, Property Taxes, and International Tax Rules.

Latvia emerges in third place overall, behind Estonia in first place and New Zealand in second place. Baltic neighbor Lithuania is in fourth and Switzerland - a country that conjures up immediate associations with tax systems - in fifth. For the sixth year in a row, Estonia has the best tax code in the OECD.