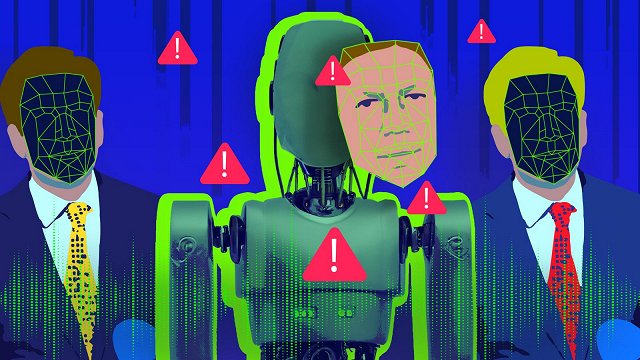

LTV begins a series of stories about various types of fraud and scam, so that as many people as possible can recognize it.

Anyone, regardless of age or education, can fall into the trap of fraudsters. It's important to understand that modern cyber fraudsters, like many of us, go to work every day. Fraudsters often work in large offices and increasingly improve methods of psychological assault. Job responsibilities in such call centers are also shared in the same way as in any company.

“Typically, there are responsibilities distributed in such call centers, there is multi-level staff. One employee's goal is to make initial calls, start communication, another employee's goal is to continue this communication by dragging the victim into an ever-larger trap,” said Oļegs Filatovs, head of Division 2 of the State Police Cybercrime Combating Administration.

Scammers most often work internationally. The call center may be located in one country, the technical infrastructure – in another country, and shell companies are established elsewhere where money can be legalized.

“These fraudsters are making millions around the world. It's millions worth of organized crime, that's how you have to look at it,” noted Cert.lv cybersecurity expert Gints Mālkalnietis.

Software engineer Elvis Strazdiņš said he once lost a large amount of money because of fraudsters himself. He is currently investigating scam schemes in his spare time so he can warn people not to fall in.

“It's a whole team. Huge as an office where they study every case. They train each other, analyze what mistakes were made in each of these cases, and at what point the victim realized it was a scam,“ Strazdiņš explained.

As well as being ready for each response, cyber fraudsters are also successfully analyzing the economic situation.

“For example, when the money saved in pensions was paid out in Estonia, when the country made this decision, the fraudsters redirected very quickly large amounts of their resources to Estonia, aware that very many people have had access to funds they have not had before, and their financial literacy and knowledge of dealing with financial resources could also be insufficient. Of course, it worked, and for that moment the amount of scams also rose,” said Laima Letiņa, an adviser to the Finance Latvia Association.

Currently, people most often fall for fake calls that aim to get internet banking access data. LTV will continue the series with the most popular types of scams.