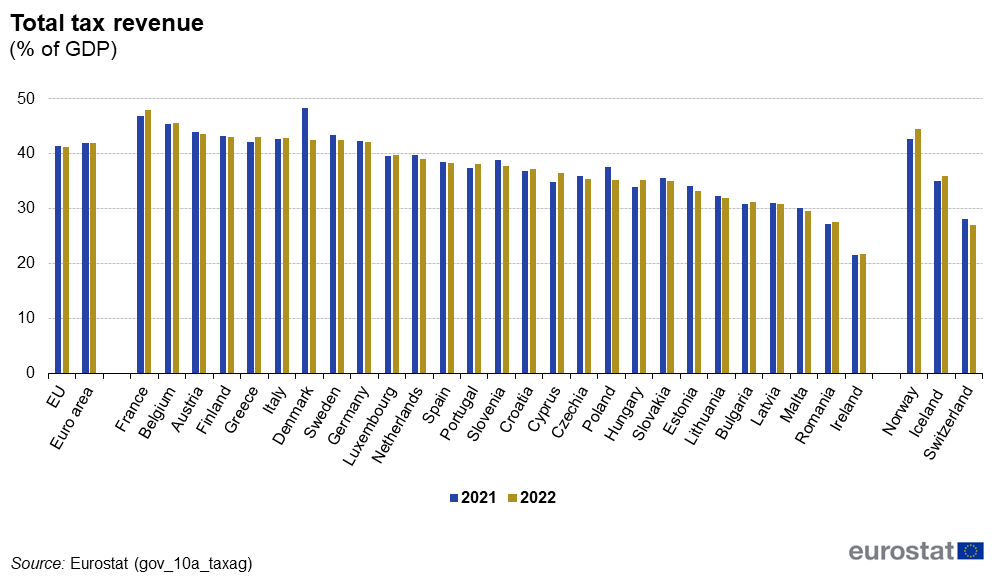

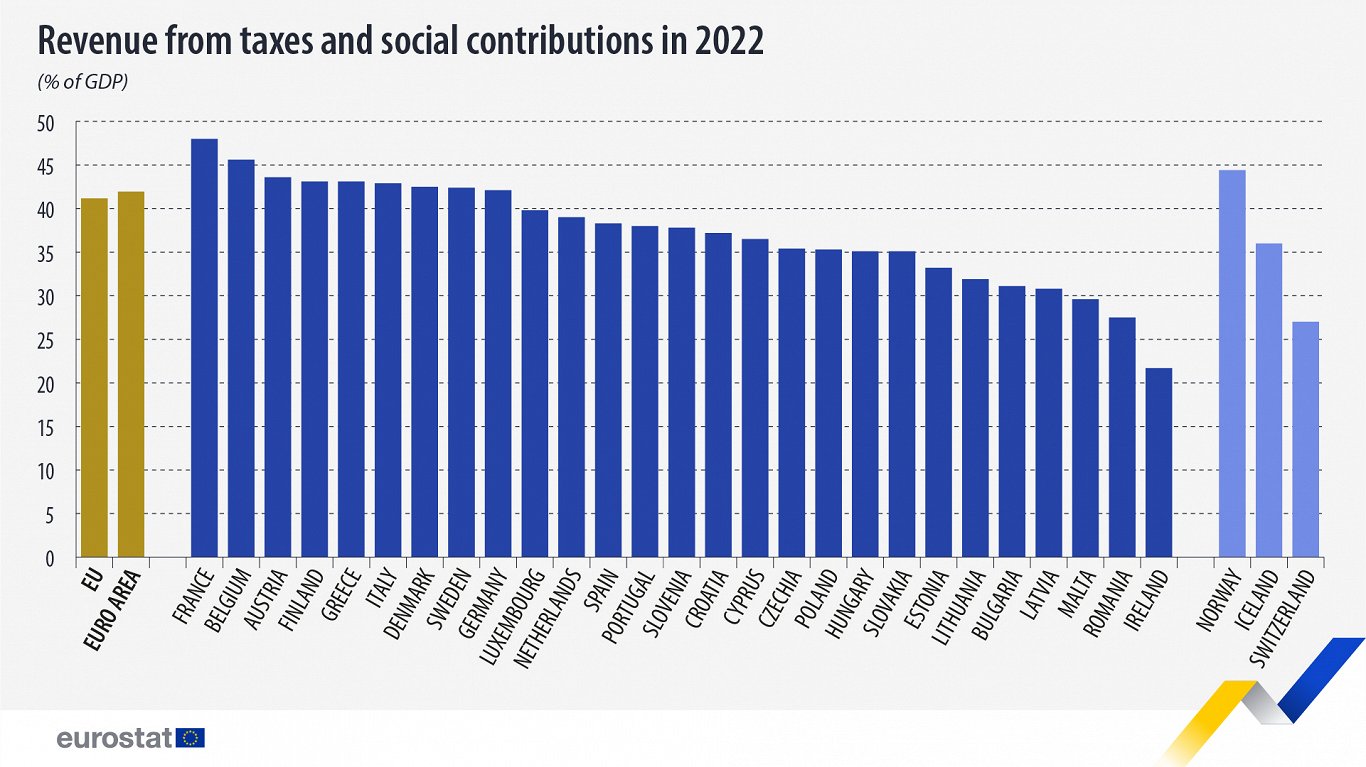

Latvia's tax-to-GDP ratio was one of the lowest in the EU, the figures show. The highest shares of taxes and social contributions as a percentage of GDP were recorded in France (48.0 %), Belgium (45.6 %), Austria (43.6 %), Finland and Greece (both 43.1 %) and Italy (42.9 %).

At the opposite end of the scale, Ireland (21.7 %), Romania (27.5 %), Malta (29.6 %), Latvia (30.8 %) and Bulgaria (31.1 %) registered the lowest ratios.

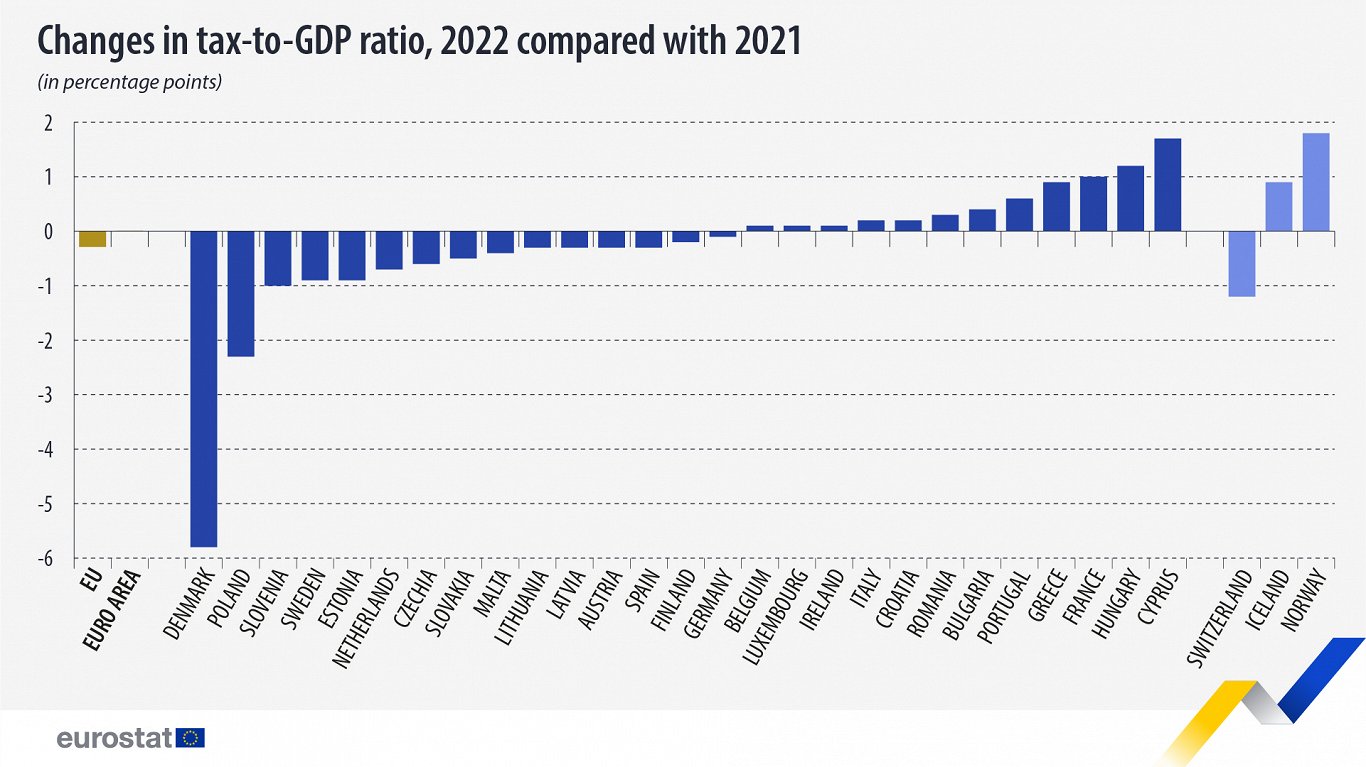

In 2022, compared with 2021, the tax-to-GDP ratio increased in twelve EU countries as well as Iceland and Norway, with the largest increases being observed in Cyprus (from 34.8 % in 2021 to 36.5 % in 2022) and Hungary (33.9 % in 2021 and 35.1 % in 2022) as well as Norway (42.6 % in 2021 and 44.4 % in 2022). The increases in the tax-to-GDP ratios are due to the faster growth in tax and social contribution revenue as compared with the growth in GDP. Latvia saw its tax-to-GDP ratio fall slightlyon the year.

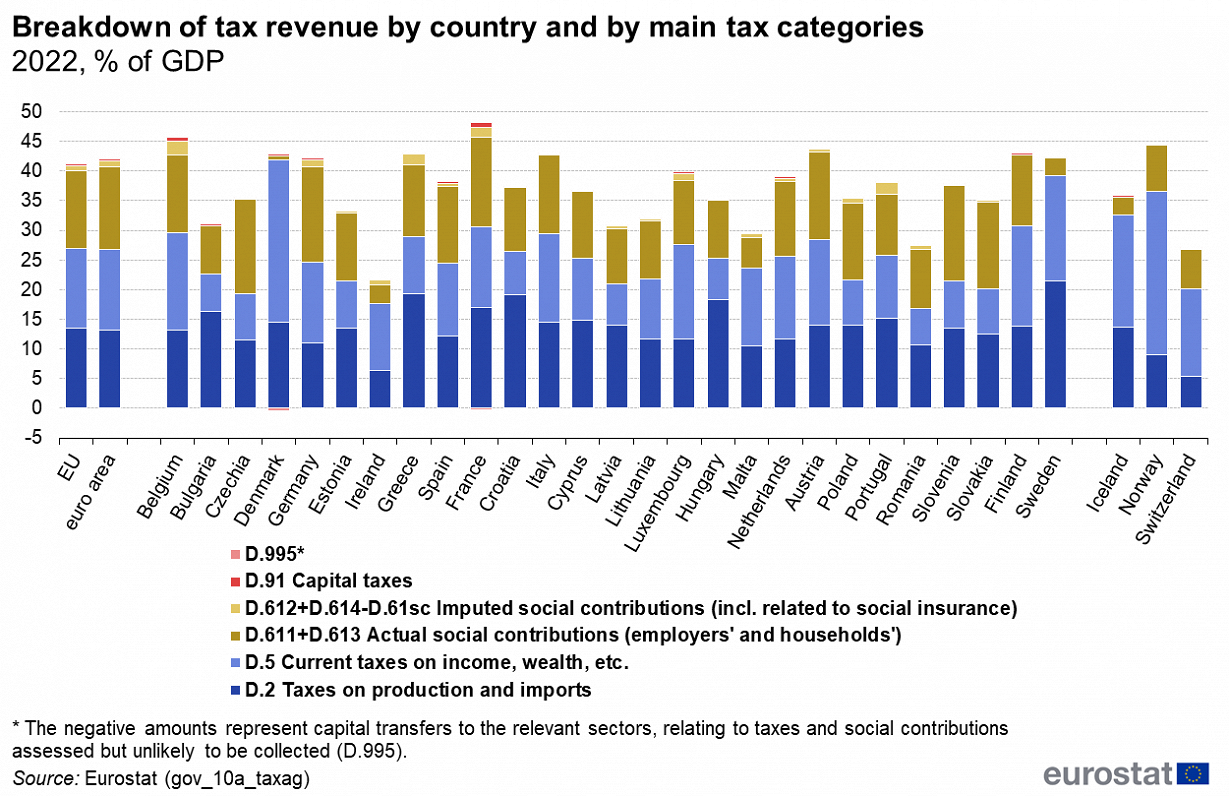

In other tax data, Eurostat noted that "By far the highest importance of current taxes on income, wealth, etc. is noted for Denmark, which raised the equivalent of 27.5 % of GDP from these taxes in 2022. The comparatively high ratio for Denmark is due to most social benefits being financed via taxes on income and, consequently, the figures for net social contributions are very low relative to other countries. The next-highest figures are recorded by Sweden, Finland, Belgium and Luxembourg, which raise 17.7 %, 17.0 %, 16.5 % and 16.0 % of GDP respectively from current taxes on income, wealth, etc. Norway and Iceland also recorded high revenue from current taxes on income, wealth, etc. - at 27.6 % of GDP and 18.9 % of GDP respectively in 2022. At the other end of the scale in 2021, Romania (6.1 % of GDP), Bulgaria (6.2 % of GDP), Hungary (6.9 % of GDP), Latvia (7.0 % of GDP) and Croatia (7.2 % of GDP) had relatively small revenue from these taxes and also show a generally low tax-to-GDP ratio."