The average credit limit issued to customers is 1,631 euros, and customers spend around 35% of the allocated credit limit on average.

Credit card funds are most actively used by young people and persons with a worse credit rating, the least by senior citizens and customers with a high credit rating, according to the information.

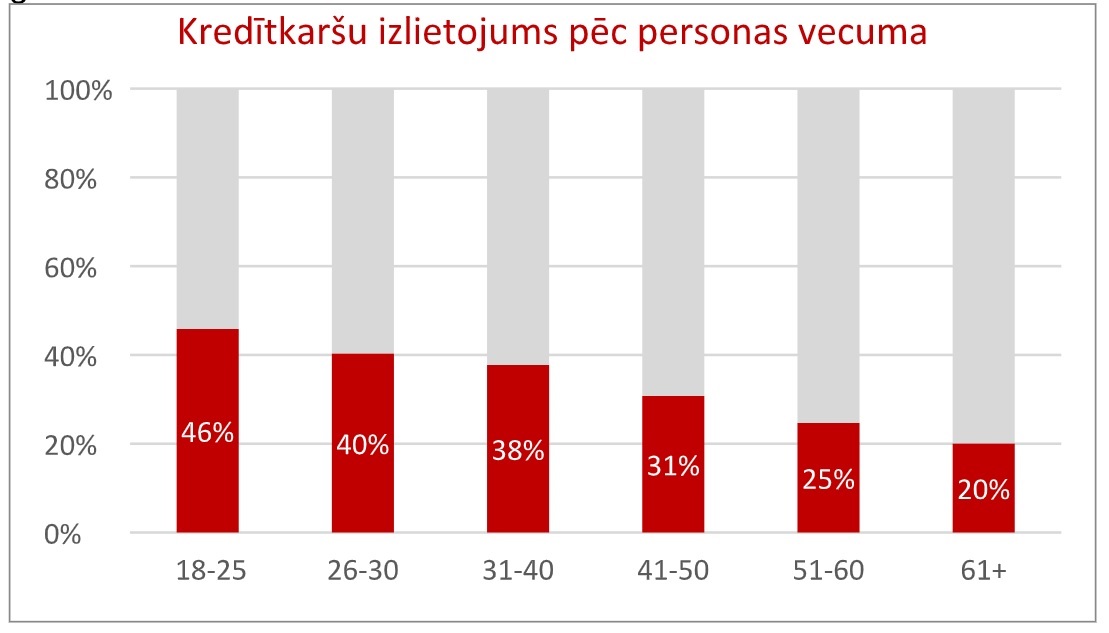

Customers in the age group from 18 to 25 spend an average of 46% of the granted credit limit. As the age of the population increases, the share of credit limit utilization gradually decreases. Customers older than 60 spend on average only 20% of the credit limit (see graph below).

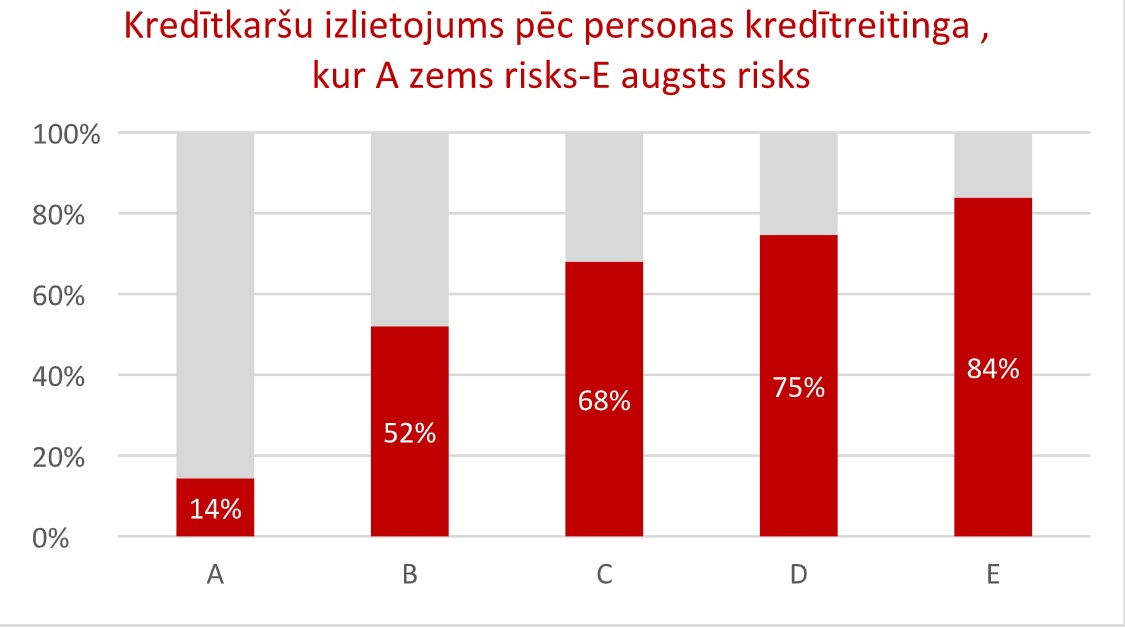

Over the last year, the limit used by cards has increased by 2% on average. On the other hand, when evaluating customers by credit rating, persons with the highest or A rating have most significantly reduced the amount of the used limit from 19% to 14% during the year. In general, the trend is unchanged, the worse the credit rating, the higher the use of cards - customers with the worst or E rating have spent 85% of the allocated funds (see graph 2).

40%, of issued credit cards have a limit of up to 1,000 euros. For every third customer (30%), it is between 1,000 and 2,000 euros, for about a quarter (23%) between 2,000 and 5,000 euros and for only 6% it exceeds 5,000 euros.

The highest average credit limit is for customers in the age group from 31 to 40 years - 1848 euros, and the lowest for young people from 18 to 25 years - 1397 euros.

"Before the pandemic, the number of credit cards issued was much higher, but only about half of the credit limits were actually used. In the first year of the pandemic, there was a significant drop in new credit card issuance, but it has since gradually increased again. At the moment, it exceeds the pre-pandemic level, and the majority, or more than 90%, of the granted credit limit actually use it," said Intars Miķelsons, executive director of AS "Kredītinformations Birojs".

For 40% of individuals who have used a card's credit limit, these are the only active credit obligations, while 60% of customers also have other financial obligations - most often a consumer loan (41%), a housing loan (25%) or a credit line (18%).

AS "Kredītinformations birojs" is a licensed credit bureau that currently manages the largest credit history database of individuals and legal entities in Latvia.