The majority do not pay attention to which bill is paid first, or all payments are made at the same time, according to a survey of 1,000 Latvian residents conducted by the Credit Information Bureau (AS "Kredītinformacijas Birojs") a licensed credit bureau that currently manages the largest database of credit histories in the country.

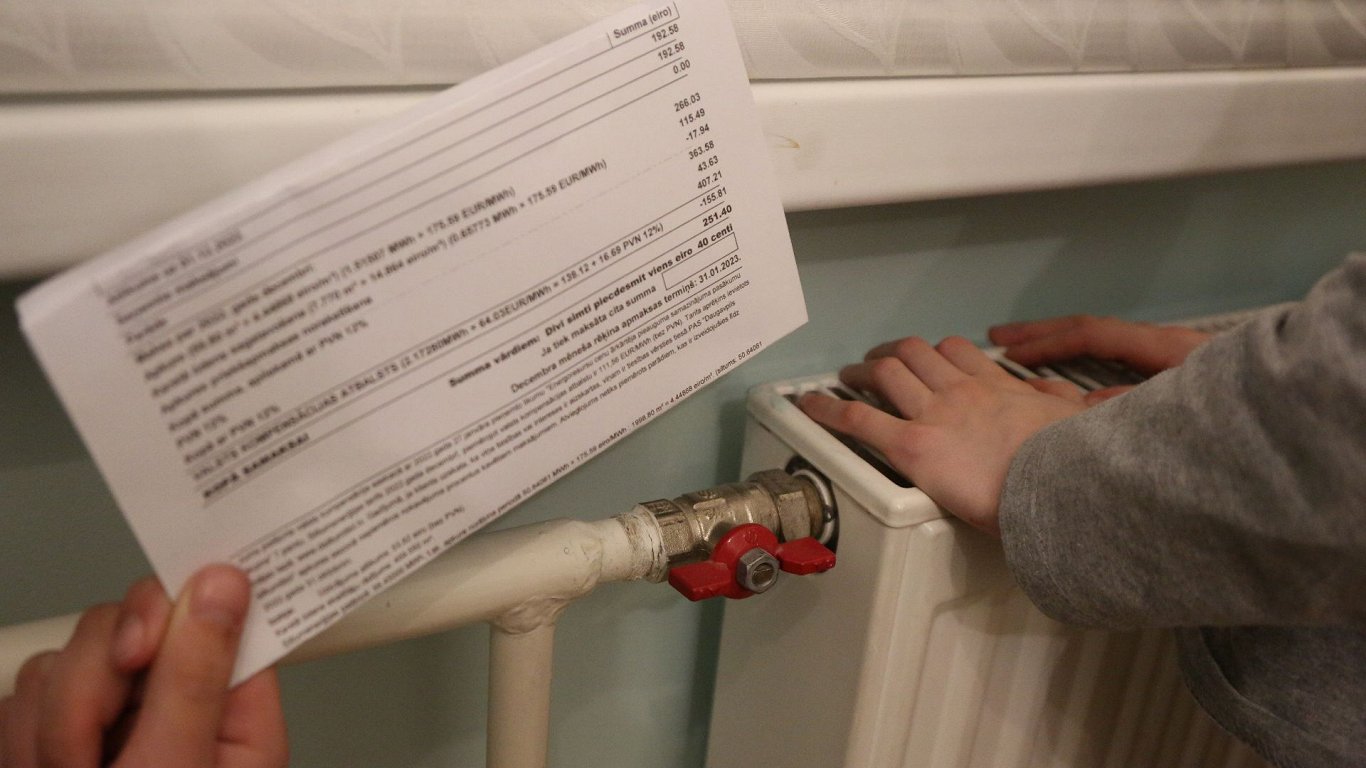

Almost all respondents (98%) pay their monthly payments via an internet bank. Every fifth respondent (20%) spends up to 200 euros for regular payments, and every third (32%) between 201 and 400 euros. The rest set aside more for making payments - 18% from 401 to 600 euros, 12% from 601 to 800 euros, 16% over 800 euros, while 2% said it was difficult to answer.

Those who make regular bill payments spend an average of 486 euros on payments per month. 30- to 39-year-old Latvian residents, men, those living in Pierīga and other Latvian cities, as well as residents with children and relatively higher monthly incomes - over 1,200 euros per hand, pay significantly higher amounts per month. Similarly, those who use various financial services, such as mortgage loans, car leasing, bank and non-bank consumer loans, have higher monthly expenses. Relatively high amounts - over 600 euros - are also paid by those who assess their family's financial situation as bad.

"These data confirm once again that taking on credit obligations should be carefully considered, as they significantly increase the monthly amount of regular payments. Since relatively large sums are also paid by those who rate their financial situation as bad, it means that the volume of credit obligations taken on by them is too large, which makes everyday life difficult, or the citizens lack adequate knowledge and skills to manage their finances," commented Intars Miķelsons, executive director of the Credit Information Bureau.

Looking at different types of bills, the largest average payment to residents is for a mortgage loan (384 euros), followed by rent payment to a landlord (248 euros) and monthly car lease payments (237 euros).

Just under a fifth (18%) admit to paying attention to which bill they pay first. This is more often done by residents with relatively lower personal income (up to 500 euros) and lower income per household member (up to 400 euros). Likewise, the order of bill payment is important for those who generally admit that their family's financial situation is bad, as well as for residents with consumer loans and/or installments issued by non-bank lenders.

41% of respondents indicated that they do not pay attention to which bill they pay first, while 36% pay all bills at the same time.

The research was conducted by the company "Norstat" in February 2024 , surveying 1,000 Latvian residents aged between 18 and 60.

For reference

AS "Kredītinformacijas Birojs" (KIB) is a licensed credit bureau that currently manages the largest database of credit histories of natural and legal persons in the country. KIB operates in accordance with the Law on Credit Information Bureaus of Latvia, the shareholders are the largest commercial banks in Latvia. The company belongs to one of the largest groups of international credit information service providers, "Creditinfo Group". More - www.kib.lv