The Paying Taxes 2018 report ranks Estonia 14th and Lithuania 18th.

In Latvia, the TTCR is 35.9 percent, the time spent on tax compliance is 169 hours and the number of the required payments is seven. In Estonia, it is 48.7 percent, 50 hours and eight payments. In Lithuania, it is 42.7 percent, 109 hours and 11 payments.

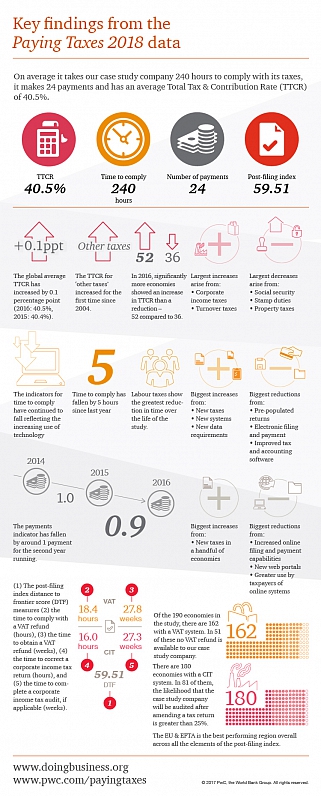

The average TTCR in the EU and EFTA countries is 39.6 percent, time to comply is 161 hours and the number of payments is 12. The global TTCR is 40.5 percent, time to comply is 240 hours and 24 payments are required.

The average time to comply with a VAT refund for the EU region is 7.1 hours, and it takes on average 16.4 weeks to obtain the VAT refund. However in Latvia (along with Croatia, Germany, Netherlands, Spain, UK and Malta) the VAT refund takes no extra time to claim as the claim is made on the standard VAT return.

In Italy it would take the case study company used in the report 42 hours to comply with a VAT refund and it would wait almost 63 weeks to receive the VAT refund. These are the longest times in the region. In Estonia it would take only 2.3 weeks to obtain a VAT refund, the quickest in the EU & EFTA region.

Lithuania also won praise, with the report saying: "The development and phased roll out of an electronic platform for filing and paying corporate income tax and social security contributions in Lithuania began in 2004. From 2016, the system has been fully operational and has been used by the majority of taxpayers resulting in a substantial reduction in the time to comply. Furthermore, registers of VAT invoices must now be filed online. Overall, the time to comply for Lithuania fell by 62 hours to 109 hours."

Based on Paying Taxes 2018, Qatar has the most attractive tax system in the world, followed by the United Arab Emirates, Hong Kong, Iceland, Bahrain, Kuwait, Singapore, Denmark, New Zealand and Mauritius.

Venezuela is at the very bottom of the list, and the situation with taxes is only slightly better in Chad, the Central African Republic and Bolivia.

Paying Taxes 2018 a joint annual publication by the World Bank Group and PwC looks at tax regimes in 190 economies. This year marks the twelfth year of the publication. You can read the full report HERE.