"After the initial fright, consumers across the Baltic countries have regained confidence and the willingness to spend. Even the real estate market barely suffered a dent – transactions and prices are rising, indicating little fear about the longer-term prospects. The economic recovery can be halted if the virus resurges and creates yet another shock to economic sentiment, investments, consumption, and exports," Swedbank said, while noting that it had revised predictions of deep recessions upwards to more modest and short-lived economic contractions.

With regard to Latvia specifically, Swedbank said the country has been relatively successful at managing the COVID-19 crisis so far, and the economy has suffered less than the rest of euro area.

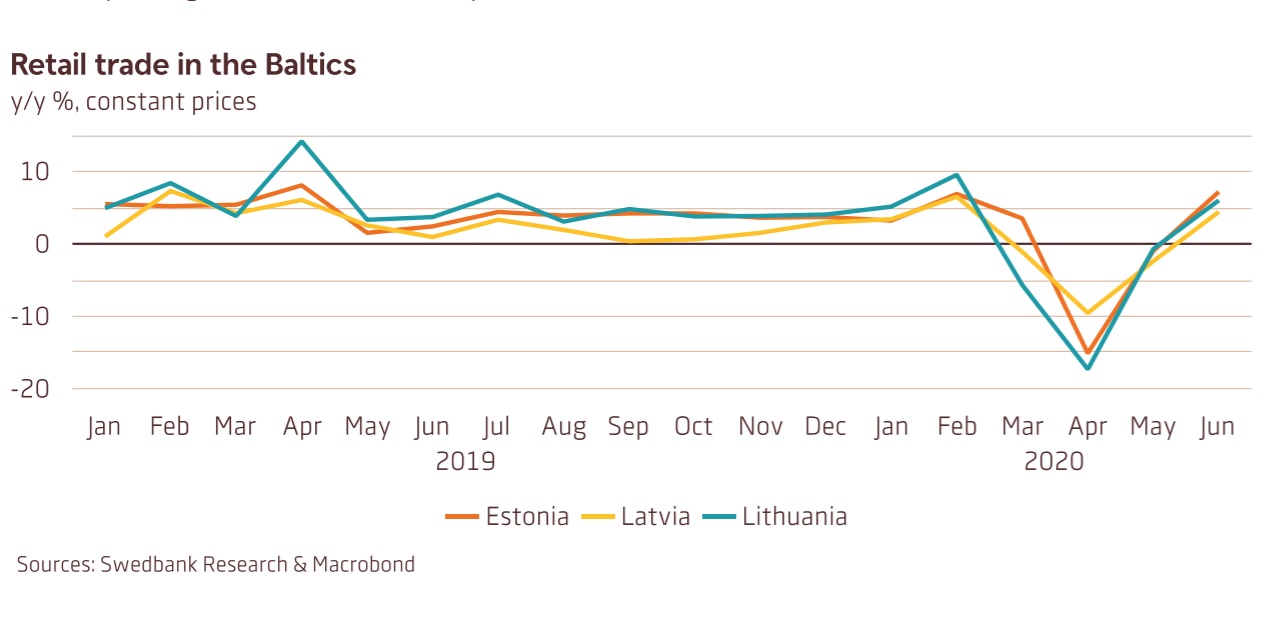

"Following a sharper than expected drop in the first quarter, activity in the second quarter declined by 9.8% over the same period of the previous year. Several parts of the economy are recovering faster than expected. For instance, industrial production, goods exports, and retail trade seem to have recovered to close to or even above the levels of last year. The registered unemployment rate peaked in June, with government support limiting the extent of the increase. Due to improving economic activity and the opening of more seasonal jobs, the number of registered unemployed inched down in July and early August. Survey data points to an improving outlook, with industrial and construction confidence approaching their long-term averages, while remaining below last year’s levels.

"Meanwhile, services confidence is still notably depressed and has seen slower improvement than other sectors. We expect GDP in the third quarter to reflect a strong rebound, with the economy regaining much of the ground lost in the first half of the year. Overall, assuming the virus remains largely under control going forward, GDP projections in mid-May seem to have been overly pessimistic. The forecast for this year has been raised to -5%," Swedbank said.

According to Swedbank's forecast, the economy is projected to reach its pre-crisis level by the start of 2022, even slightly earlier than a prediction of mid-2022 made on August 22 by rating agency Standard & Poor's.

However, the availability of a suitable workforce remains a longer-term problem.

"We expect the unemployment rate to gradually decline, averaging 8.3% in 2020, with a more marked recovery going forward... Labour shortages are expected to reappear in some sectors as a result of broad-scale construction works and investment projects, boosting wage growth in the next two years to 5.5% and 6.0%, respectively," Swedbank concluded.

The full report can be read online.

In its Nordic Outlook report also published August 25, rival Swedish bank SEB made an even more upbeat assessment, saying:

"In the Baltic countries, Lithuania in particular has weathered the crisis unexpectedly well. The small size of its tourism sector and vigorous fiscal support for households will limit this year’s GDP downturn to 1.3 per cent, followed by annual increases of 3 per cent in 2021 and 2022. Latvia and Estonia are harder hit, but less than previously expected. GDP will fall by about 4.5 per cent in both countries during 2020, followed by an upturn of 4-4.5 per cent in 2021 and 3.5 per cent in 2022."