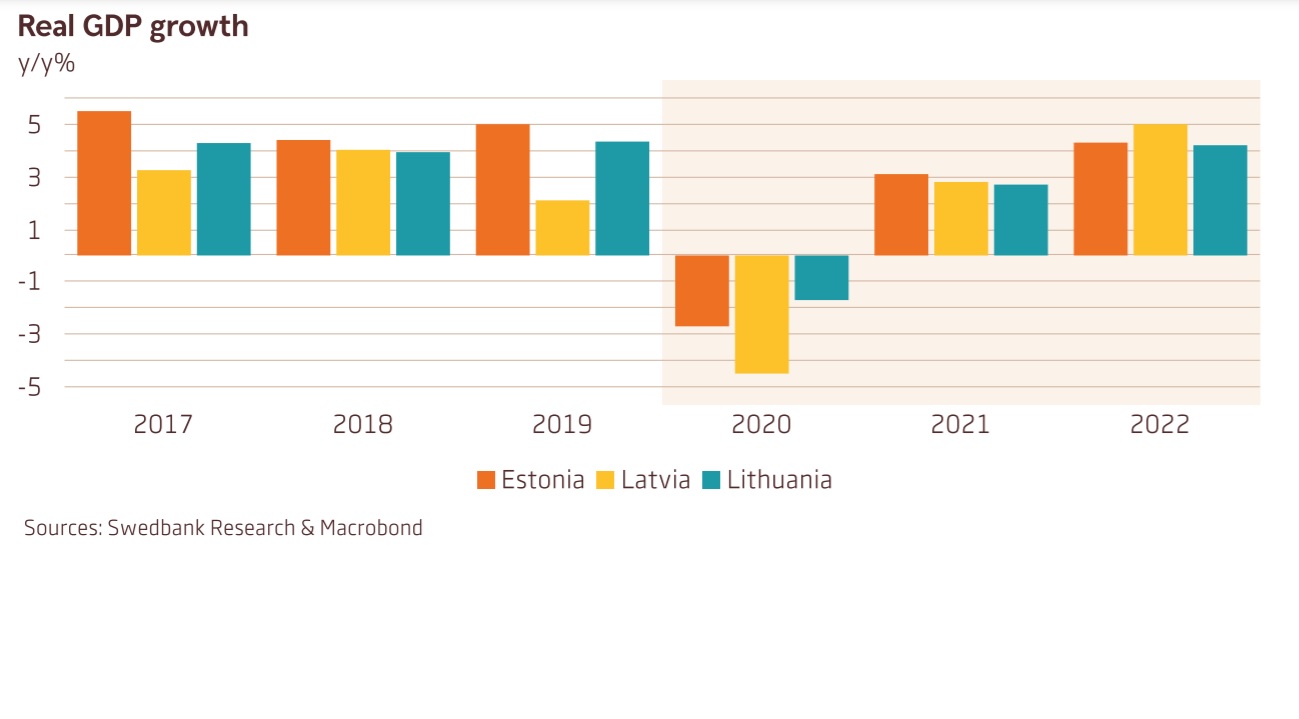

"The Baltic economies suffered relatively small economic setbacks during 2020. Alas, the last year has ended and this one begins with the pandemic still far from being contained, meaning that prolonged stringent lockdowns will continue dragging down growth. We see all three Baltic economies starting to recover more forcefully only in the second half of this year, with GDP growth rising above 4% in 2022," Swedbank said.

"The Baltic countries, especially Latvia and Lithuania, are suffering one of the worst second waves of COVID-19 in the world. Even though the vaccine news is encouraging, the vaccination process will be slow, and most restrictions to economic activity are likely to remain throughout the first quarter of this year, some even longer. This suggests a weaker-than-expected start of the year, prompting a downward revision of GDP growth in 2021," Swedbank said.

"There is a risk that a large share of the populations will opt out of the vaccination; this would prolong the path towards herd immunity and postpone economic recovery," the bank warned.

Despite better-than-expected end to 2020 for Latvian GDP, which was in part attributable to the British stocking up on Latvian wood before Brexit restrictions hit, Latvia currently faces a serious challenge and the government needs to "step up its game" according to Swedbank.

"Going forward, the bleak virus situation and the rocky vaccine rollout suggest a weaker-than expected start of 2021, prompting a downward revision of GDP growth (to 2.8%). The announced tax policy changes include a welcome shrinking of the labour tax wedge for a large share of employees. The introduction of minimum social security contributions, as well as several changes affecting micro businesses, are welcome in the longer term. However, they can potentially add to the grey economy and dampen overall confidence in the short run," Swedbank warned.

The full report can be read online.