The forestry sector is an important part of the national economy in Latvia, Lithuania and Estonia. The Baltic region rapidly entered the world market arena in the 1990s and today it is constantly investing in new technologies, searching for new development opportunities for the further processing of products. In recent decades the forestry sector in the Baltic region has been able to very quickly “catch up” with what was lost during the 50 years of occupation. In the first stage it was even relatively easy, but already for some time the pace of future growth depends on much closer cross-sectoral and cross-border cooperation, the development of productivity enhancing technologies and well considered long-term decisions regarding resource management.

Over the last 30 years, the curves that characterise the industry have risen by almost 45 degrees, with the only “gap” in 2009, but there is a well-known, global explanation for this. In general the added value of the forestry sector in the Baltic region has increased almost six times over the last 20 years, and currently the sector forms ~5% of the added value created in the Baltics, directly employing 143 thousand residents of the region.

The Baltic forestry sector is not only important at the local level. For example, according to the export of softwood saw-timber in global competition, the Baltic region is located between Austria and the USA, ranking in 7th place. The Baltic states are in second place after the United States with regard to the export of pellets. The Baltics take first place in the export of prefabricated wooden houses in Europe, and we are in the TOP 5 in the export of OSB and birch plywood. In general the Baltic production industry of wood slabs is larger than in Finland.

The commercially used forests of the Baltic states accumulate 6% of the total amount of wood in Europe, the region combined employs 6% of EU wood industry workers and 7% of EU forestry and logging workers.

In the Baltic states, labour is increasingly lacking, therefore this “defect can be turned into an effect”. Unlike, for example, the Netherlands and Denmark, which are well known as producers of excellent wood products, but where there are almost no commercial forests, in the Baltics, similarly to in the Nordic countries, wood processing has been historically very closely linked to forestry based on ancient traditions. Undoubtedly, one of the main conditions that has enabled the Baltic states to become a strong region of forestry and woodworking knowledge and technologies, is the climate provided by mother nature that is favourable for focused forest growing, the soil conditions and the geographical location especially suitable for product logistics. As well as the high quality of softwood in the region – an important basis for the development of strong sawmills, which in turn has provided the basis for further development of the processing industry.

It is no coincidence that the factories of almost all major Scandinavian wood processing companies can now be found in the Baltics.

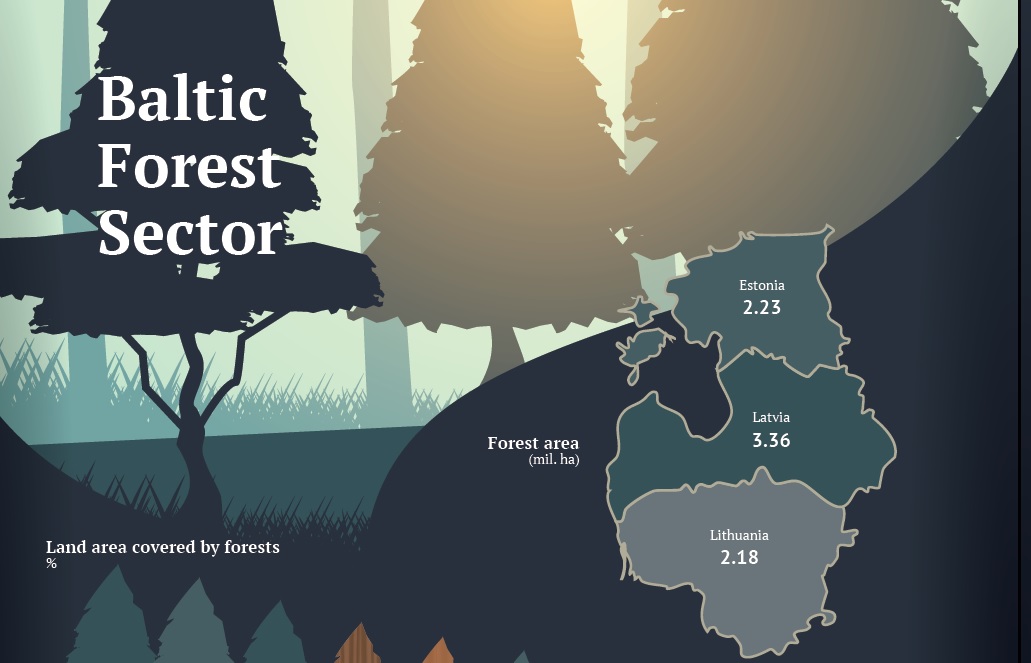

Over the last 100 years, the area of the Baltic forests has doubled, while the timber stock has increased 3.7 times to 1.7 billion m3. The main commercial tree species are currently pine (Pinus sylvestris), birch (Betula pendula), spruce (Picea abies), white alder (Alnus incana), aspen (Populus tremula) and black alder (Alnus glutinosa).

Along with the local wood resources, the wood processing sector in the Baltic region, especially in the sawmill segment, is also partly based on import – both round timber and saw-timber. Mutual trade of round timber within the Baltic region is distinctly active, especially between Latvia and Lithuania. All three Baltic states are becoming an increasingly important wood processing centre. For example, every year the Baltic states buy increasingly more saw-timber or boards from Belarus and Russia, adding value to these products by processing or re-processing them and exporting them further. In total, the Baltic states import boards (incl. within mutual transactions) worth almost 0.5 billion euros.

Apart from mutual trade, Baltic round timber export is mainly composed of pulpwood for the Swedish and Finnish pulp industries. Export volumes fluctuate however, as they are significantly affected by the purchase price.

The fact that the reorientation of the sector from a planned to market economy took place relatively quickly in the early 1990s can be mainly explained by the low cost – round timber in the Baltics was cheap, but average wages did not exceed 100 euros per month. As a result, a wide network of small, simple sawmills flourished, including large industrial companies in areas that have now become flagships of the Baltic forest industry and large cluster centres, marking the specialisation of each country – in Estonia the production of prefabricated wooden houses is more developed; in Latvia – the production of slabs, especially birch plywood, but in Lithuania – the production of furniture.

For example, sawmills in Latvia process a significant amount of softwood saw-logs obtained in the Lithuanian forests, but the supply of chipboard produced in Latvia is very important for the Lithuanian industry of panel furniture. Estonians are buying sawn timber from Latvia for the production of wood frame houses, while Latvians are buying other types of saw-timber from Estonians for the production of glued building structures. In order to be closer to the raw material, “Latvijas finieris” has set up production facilities in all Baltic states, but at the same time has integrated the production processes quite closely. The flow of people across the borders is also common; for example, the restrictions imposed by COVID-19 on people moving across the borders have created a labour shortage in wood processing companies in southern Estonia.

For a long time now, long-term development in the Baltic states is being focused on the further wood processing industry based on primary processing products.

The pulp industry has shrunk considerably since Soviet times and now only exists to a relatively small extent in Estonia, where Kraft packaging paper is produced, for which demand is growing steadily due to the growing global internet sales. From time to time new early research projects for the possible production of mechanical wood fibre production and related further processing products are carried out in the Baltic states. There are already plenty of small foundations in the chemical processing of wood in the Baltics, various extracts are produced in small quantities, and there are a number of larger and smaller green pharmaceutical companies. The level of wood chemistry science is also high; the only thing that has been lacking so far is the scaling capacity of pilot projects and the commercialisation of investment ideas.

Companies in the Baltic states invest relatively much in the latest knowledge and technologies compared to the rest of Europe, often more than 10% of their annual turnover. As a result, already now, the most modern forest industry companies in the Baltics, which produce about 70-80% of the total production, are in many ways very similar to their competitors in Scandinavia. Maybe even a little more modern, as the technical base has been established relatively recently.

In the European sense the Baltic companies are not large, but at a regional level they are important enough players to form complex cluster structures around them.

You can read more about the German-Baltic Chamber of Commerce in Estonia, Latvia and Lithuania at the official website and find out more about the Baltic Business Quarterly magazine here: https://www.ahk-balt.org/lv/publikacijas/zurnals.