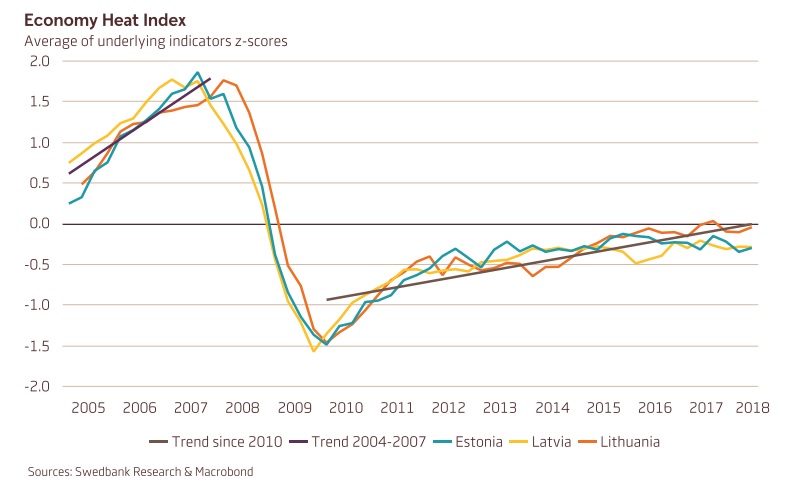

"The Baltic economies are now fully recovered from the past recession, and the output gaps have been fully closed in all three countries. However, the economies are continuing to expand at above-potential rates. Moreover, economic confidence is close to all-time highs, unemployment is the lowest in a decade, and wages are growing at an accelerated pace. Thus, one cannot avoid asking, Are the Baltic economies on a sustainable path or could they be heading towards an overheating?" says Swedbank.

Although the temperature is slowly rising, driven by a tight labor market, it has not yet translated into high inflation and a buildup of imbalances elsewhere.

"An overheating economy is one where productive capacity is unable to keep pace with growing aggregate demand. This situation results in an overemployment of resources and high and rising inflation. This period is usually marked with excess optimism and confidence over the economy’s future prospects, which leads to inefficient supply allocations and, possibly, a buildup of bubbles (e.g., in housing, the stock market), a trade deficit, and other economic imbalances," Swedbank helpfully explains in an account of what happened during the "Baltic Tiger" bubble of 2007-8.

"Overall, the economy heat index shows that the Baltic economies are warming up slowly. Years of solid growth in the Baltic economies and negative demographic trends have led to a situation where finding labor is increasingly hard or very expensive. Unemployment is already close to the pre-crisis level. Although the lack of labor is pronounced and wages are growing at an accelerated pace, the growth in labour costs is not too detached from productivity growth," Swedbank says.

"But the gap could widen if labor shortages become even direr. Rising incomes, increased optimism, higher willingness to consume and the same time mounting capacity constraints create conditions for price pressures to build up. Moreover, when economies with no spare productive capacity have trouble to meet the expanding aggregate demand, this results in deteriorating current account balance as the excess demand is satisfied with imported goods and services," it adds.

"When expectations about the future rise, consumers may become less risk-averse and thus more willing to borrow, this in turn fuels demand growth. These conditions then translate to inflated asset prices, possibly even forming bubbles... But we are not there yet," says Swedbank.

"The situation requires close and continuous monitoring, and some actions may be needed. Productivity-boosting reforms and a looser immigration policy could put the economies on a more sustainable track," Swedbank recommends.