The recommendations were drawn up in collaboration with the industry itself and are advisory rather than compulsory with legally-binding obligations.

"The extensive work on recommendations has been carried out in conjunction with the industry, based on practical application, establishing a dialogue, promoting a common understanding and mutual trust between all shareholders," FKTK said in a statement.

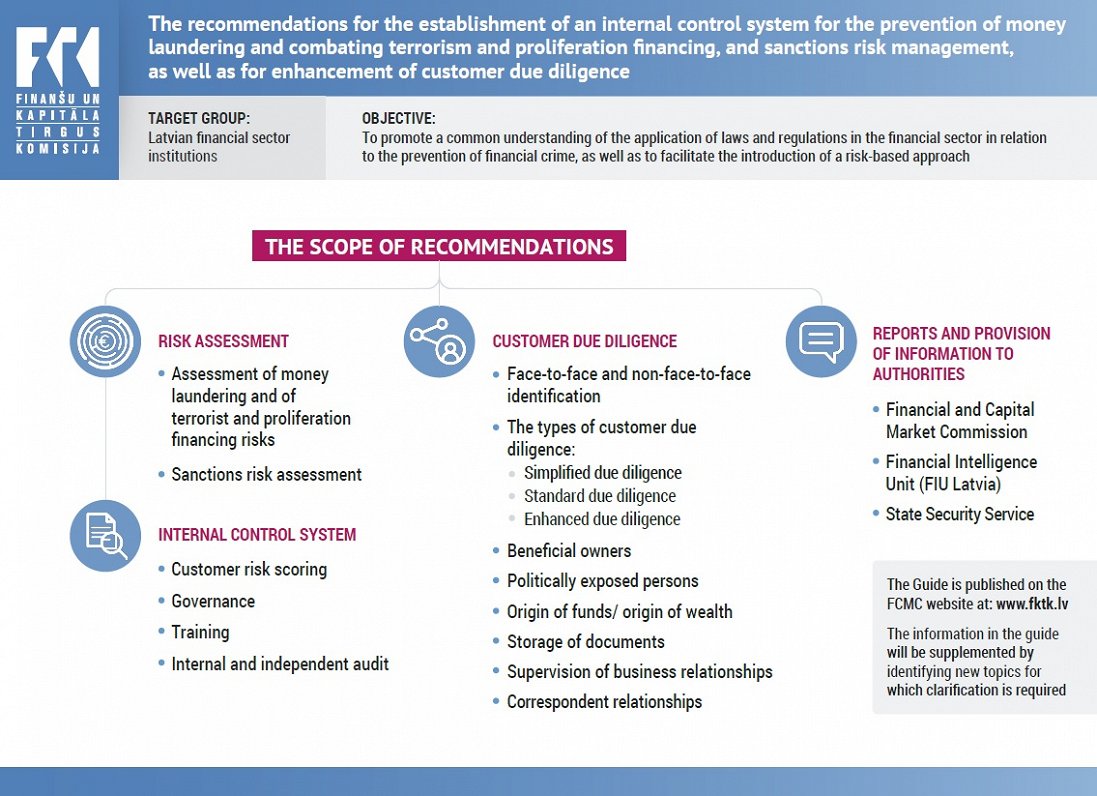

"The objective of the recommendations is to have a common understanding on both the banks and regulator's side of the application of laws and regulations in the area of the prevention of financial crime, as well as the introduction of [a] risk-based approach," FKTK said.

"The recommendations are drafted to establish an internal control system for the prevention of money laundering and combating terrorism and proliferation financing (AML/CTPF), and sanctions risk management, as well as customer due diligence. The existing recommendations provide an explanation and examples in areas such as risk assessment, development of the internal control system and customer due diligence," it added.

FKTK Chairwoman Santa Purgaile said: ”We have developed a practical guide for financial institutions to improve their internal processes in the prevention of financial crime and performing customer due diligence. Through these recommendations we wish to facilitate the implementation of a risk-assessment approach, which is one of our priorities. This means that, for example, lower-risk customers are undergoing less extensive due diligence, while high-risk customers are subject to more comprehensive and in-depth examination."

Sanita Bajāre, Chief Executive Officer at the Finance Latvia Association, which includes most, but not all of Latvia's banks in its membership, said: "Combating financial crimes is important both at national and global level. Latvia has significantly improved its system for preventing financial crime and money laundering. But the work on the development of the system is ongoing. The guide approved by the FCMC to strengthen the risk-based approach is a step towards more flexible, efficient and proportionate cooperation between the bank and its clients, as well as between the supervisor and a bank. The work done jointly may potentially result in the simplification of money laundering procedures and the reduction of administrative burdens for clients, helping to find an appropriate approach to each client's risk level."

The recommendations are available to read and download at the FKTK website. They run to some 91 pages.

Publication of the recommendations is the latest initiative in an ongoing attempt to shed the reputation of the Latvian banking sector as a conduit for dirty money from the east. Following the sanctioning of ABLV bank by the U.S. regulator two years ago, the authorities in Latvia woke up to the threat of having the domestic banking sector placed on a 'gray list' of money laundering havens that would have caused severe economic damage. The last two years have brought concerted efforts to turn the sector around and give it a sustainable business model not based on shady practice.

In parallel, there have been major shake-ups at law enforcement bodies charged with tackling economic crime and the regulator itself is being reformed, with government plans being drawn up to merge its functions with those of the Latvian central bank.