In August 2018, NRDs accounted for 20.5% of total funds deposited in Latvian banks, down on the 2015 high when NRDs outweighed domestic deposits in the banking sector with the level at 53.4%.

Non-resident depositors now have 3.2 billion euros in the Latvian banking system as opposed to 12.4 billion in 2015. The extent to which shrinkage has occurred is clear from another fact: total depsits (including both resident and non-resident deposits) in the same timeframe have fallen from 23.3 billion euros in 2015 to 15.6 billion euros today.

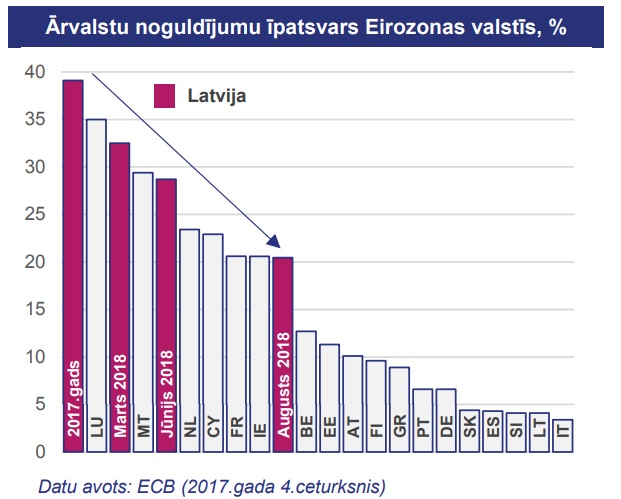

Based on ECB data, the information also shows that as recently as last year, Latvia had the highest proportion of NRDs in its banking system than any other European Union member state. But following a concerted clean-up in the wake of the ABLV bank scandal, Latvia is now in the middle of the pack, with a level of NRDs comparable to those in Ireland and France, and significantly lower than in Lithuania, Cyprus and Malta.