Following the ABLV scandal at the start of the year, policymakers doubled up on their attempts to reduce the dependency of the banking sector upon dubious sources of cash from overseas and linked problems of money-laundering and sanctions-busting.

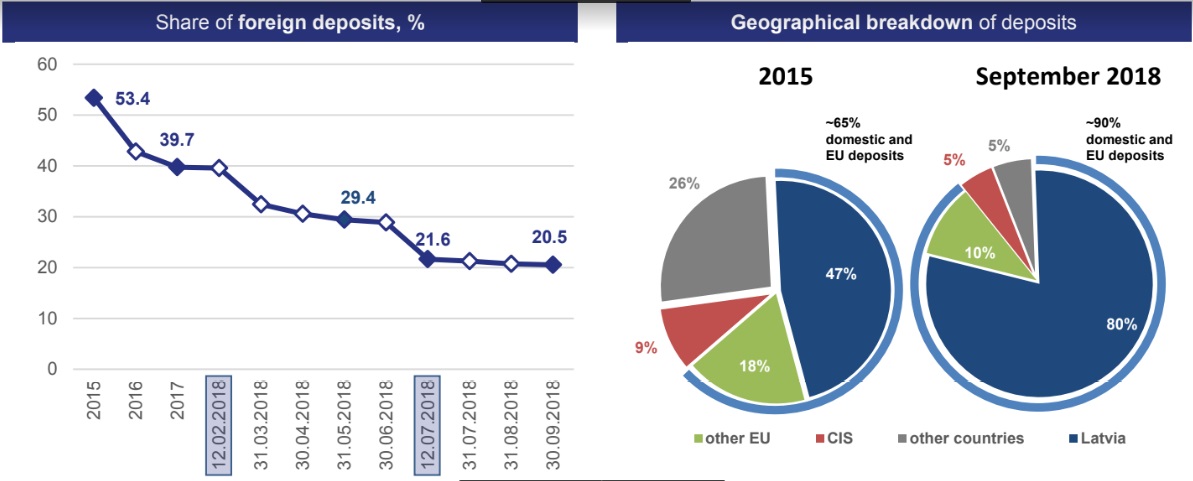

According to the data released by FKTK November 6, such measures appear to have a had a dramatic impact. See the attached PDF document for full details of the scale of the fall in non-resident deposits and the change in the geographic origin of funds moving through the Latvian banking system.

"Assessing the turnover of foreign customer assets in the period of changes this is evidenced that not only the volume of risky deposits has decreased significantly, but also the level of foreign customer payments, in particular in the US dollars," said FKTK.

"The payments shrank substantially already in 2016 with enforcing the AML/CTF risk mitigating measures. Whereas, comparing the third quarter of this year and the respective period of 2015, payments in the US dollars in Latvian banks have declined more than 10 times, thus the euro has strengthened its dominance as a payment currency in the Latvian financial sector."