The investigation includes customers, transactions and activities from 2007 through March 2019 and how the bank has handled internal and external information disclosures.

"Clifford Chance reports that Swedbank Estonia and Swedbank Latvia actively pursued high-risk customers and Swedbank Estonia accepted certain high-risk customers who had been offboarded as customers in another bank in Estonia, when that bank had decided to discontinue their business with foreign high-risk customers," Swedbank said as the report was made available.

“Clifford Chance’s report confirms the bank’s failure. In its anti-money laundering work, the bank has not measured up to the requirements that customers, owners and society are entitled to set. We now have the facts and are working hard to solve the problems”, said Swedbank’s Chairman Göran Persson.

The report shows that during the period 2014 – 2019 transactions representing a high risk for money laundering were made in the form of payments to customer accounts worth EUR 17.8 billion and payments from customer accounts worth EUR 18.9 billion in the Baltic subsidiaries. However, Clifford Chance could not conclude that money laundering had definitely taken place.

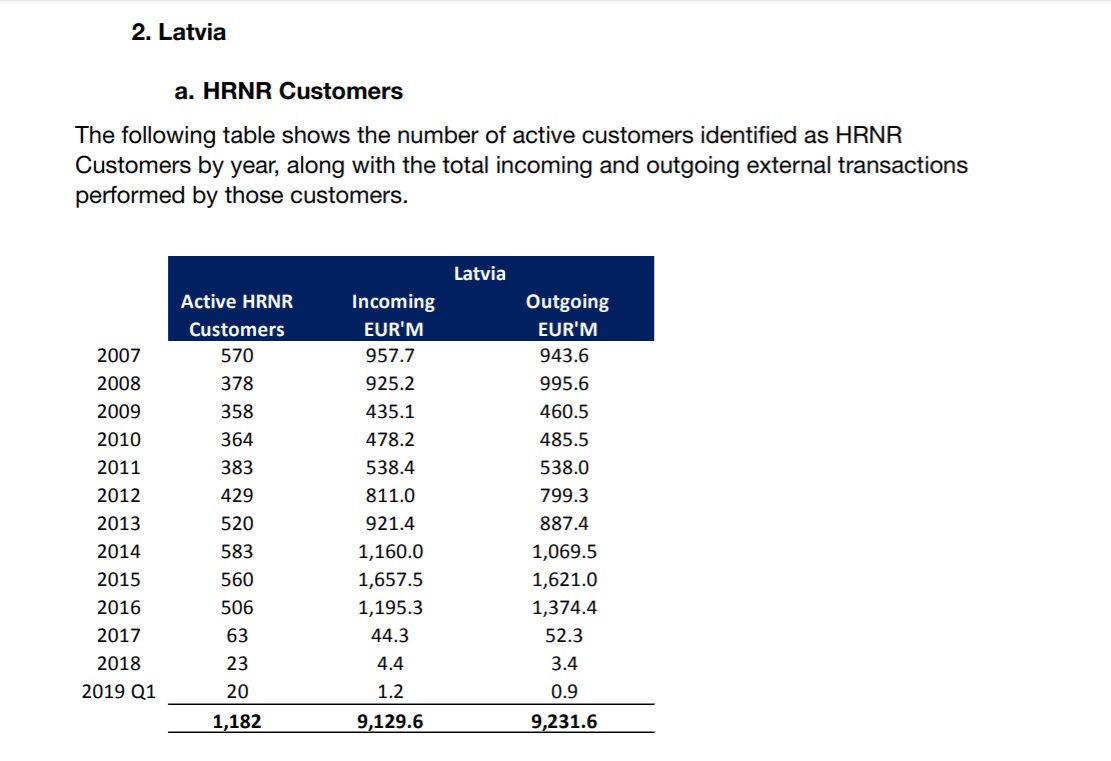

"For Swedbank Latvia, during the five-year period from March 2014 through March 2019, this exercise identified payments that totaled approximately €4.8 billion that were received into these customers’ accounts, and a total of approximately €4.5 billion that were sent by these customers from their accounts," the report says.

High-risk customers in Baltic Banking were allowed to open accounts in the bank’s other business areas in Sweden – Swedish Banking and LC&I. Clifford Chance further notes that all of these customers have been offboarded.

The report also notes that during the time regulators started to clamp down on the banks, these high risk customers started to disappear.

"At Swedbank Latvia, incoming payments decreased from a high mark of 6.8% of the total incoming payments of all customers for Swedbank Latvia in 2015, to 0.9% of the total incoming payments in Q1 2019," the report notes.

There are also some interesting forensic details about the methods used by these high-risk customers - including the operation of accounts in Swedbank Latvia apparently from occupied Crimea and Iran.

"Swedbank Latvia customers used an online banking platform to initiate 522 outgoing Subject Transactions, totaling approximately $4.43 million, of which 507 such outgoing Subject Transactions between 30 December 2014 and 30 December 2016, amounting to approximately $4.26 million, involved three shipping customers domiciled in offshore jurisdictions that had accounts at Swedbank Latvia but whose owner appeared to operate these companies from Crimea. The remaining 15 outgoing Subject Transactions from accounts at Swedbank Latvia appeared to involve non-sanctioned customers who were temporarily located in Crimea or Iran or payments by non-sanctioned customers to counterparties in Crimea. We also identified one incoming Subject Transaction for $5,970 to an individual customer of Swedbank Latvia who had a residency address in Crimea," the report says.

However none of these Subject Transactions involved any OFAC-listed [sanctioned] persons, and nearly all of them, by volume and value, occurred prior to 2017, the report notes.

Clifford Chance writes that during the period 2007 – 2019, the bank’s senior management failed to establish clear lines of AML-related responsibilities and that Swedbank’s CEO’s throughout the review period all had a lack of adequate appreciation for the risk posed by the high-risk non-resident customers to the bank. Furthermore, Clifford Chance considers certain statements during October 2018 and February 2019 concerning money laundering, were inaccurate or presented without sufficient context.

The bank also seems to have been somewhat less than fully transparent with regulators, too.

"The Investigation found that, in certain instances, Swedbank did not always take an actively transparent posture with regulators regarding AML-related issues, de-emphasized negative information and occasionally employed a narrow or literal reading of certain requests," the report says.

“It is obvious that there have been cultures in the bank that are not acceptable. This is serious. I have initiated a review which aims to examine the culture and identify actions needed. This work is under way”, said Swedbank’s President and CEO Jens Henriksson.

On March 20, Swedbank was fined 360 million euros by the financial authorities in Estonia.