Before she was confirmed in her position Sanita Purgaile, the new head of Latvia's financial regulator, the Financial and Capital Markets Commission (FKTK) promised to look into whether it was proper that the bank was allowed to undergo self-liquidation.

After a few days she was convinced that nothing needs to be changed, although US representatives have mentioned several times in informal conversations that they aren't pleased with this solution, sources told De Facto.

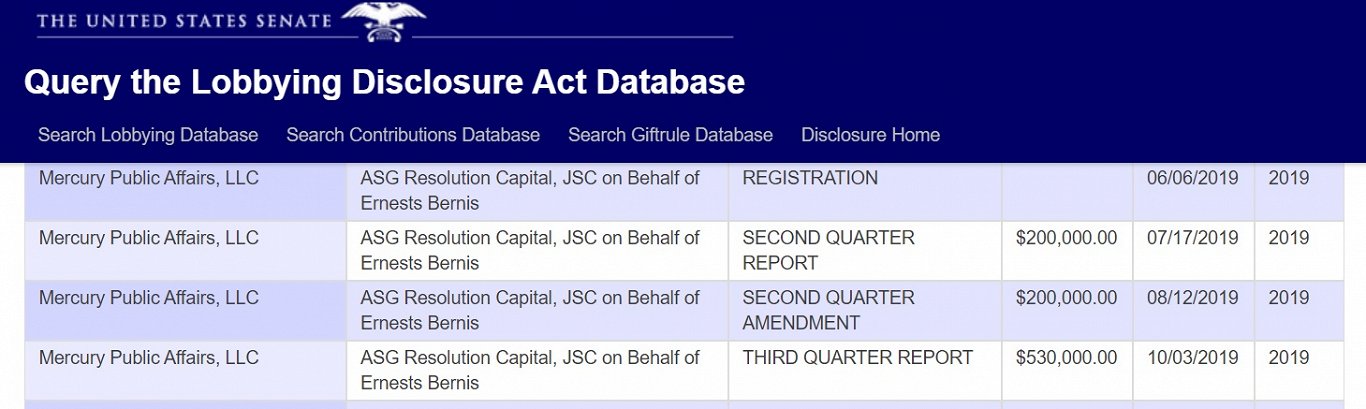

ABLV Bank Co-owner Bernis hired Mercury, one of the most influential lobbying firms in Washington at the end of May 2019, as reported by LSM at the time.

A damning Treasury Department report that alleged money laundering on a huge scale was the catalyst for the downfall of the bank, and Bernis considers that they have come to their conclusions with incomplete information.

“The assignment for the lobbyists is to provide the necessary clarifications to the American institutions,” says Bernis.

As previously reported, Bernis hired U.S. lobbyist Bryan Lanza, who worked as deputy director of communications for the presidential campaign of Donald Trump. Official lobbying disclosure documents filed in Washington D.C. identify "ASG Resolution Capital, JSC on Behalf of Ernests Bernis" as hiring Lanza (though the Rīga address is mis-spelled as 23 Elezabetes Street instead of Elizabetes Street).

A search of the lobbying database reveals that nearly one million dollars has been paid to Mercury this year.

Mercury's client list also includes Russian billionaire Oleg Deripaska, who lobbied to get U.S. sanctions lifted from his companies. Deripaska minimised his influence in the company, and the Trump administration lifted the sanctions.

Mercury was also mentioned in the fraud and money laundering case against former Trump campaign manager Paul Manafort. For several years Manafort had paid two lobbying firms to represent the Former President of Ukraine Viktor Yanukovych's interests in the U.S.. "Company A" named in a report by U.S. special counsel Robert Mueller report turned out to be Mercury. One of the partners stepped down as a result of the ensuing scandal.

In De Facto's discussion with Bernis it wasn't clear what practical gains he hopes to achieve through the lobbyists other than an attempt to "clarify information".

“We are very satisfied with the current results, but there is still a lot of work ahead. Reputation is the most important thing in the 21st century,” said Bernis.

Over the last two years 185 million euros of ABLV Bank assets have been deemed suspicious and frozen, although the suspicions have yet to be proven.

The police are currently performing 40 investigations related to these assets. The Financial Intelligence Unit has begun unprecedented international cooperation with departments in more than 20 countries, mainly with those in which the bank's clients resided, De Facto reported.

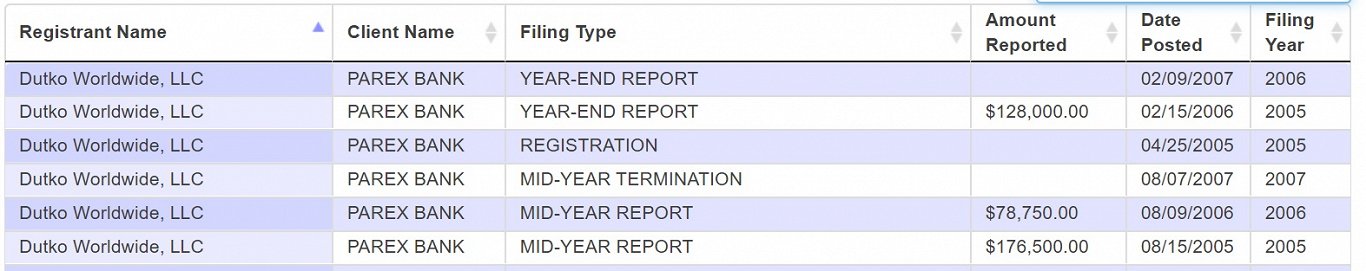

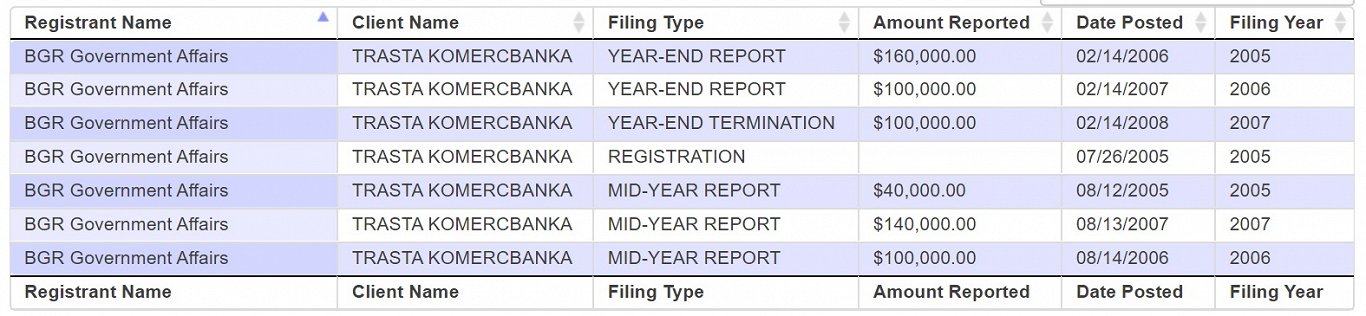

The use of U.S. lobbying firms by Latvian banks is nothing new. As the search results below show, two other now-defunct banks, Parex banka and Trasta Komercbanka also has representatives acting on their behalf in Washington.