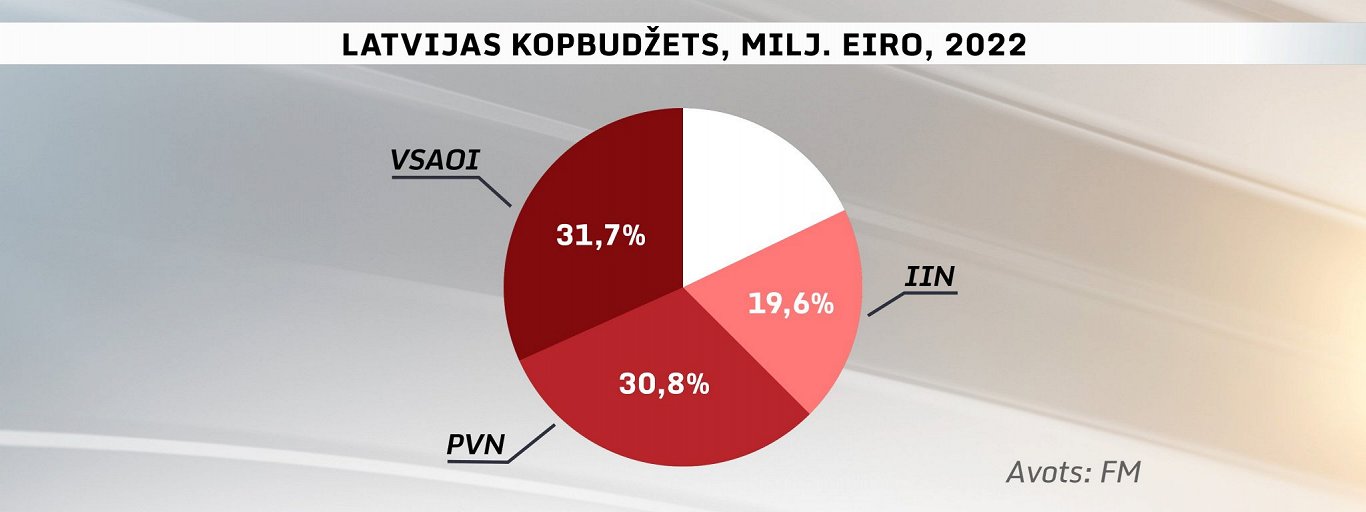

Value-added tax in Latvia brings about 30% of the budget revenue, so it is the second most profitable tax after the mandatory State Social Insurance contributions; the third is personal income tax.

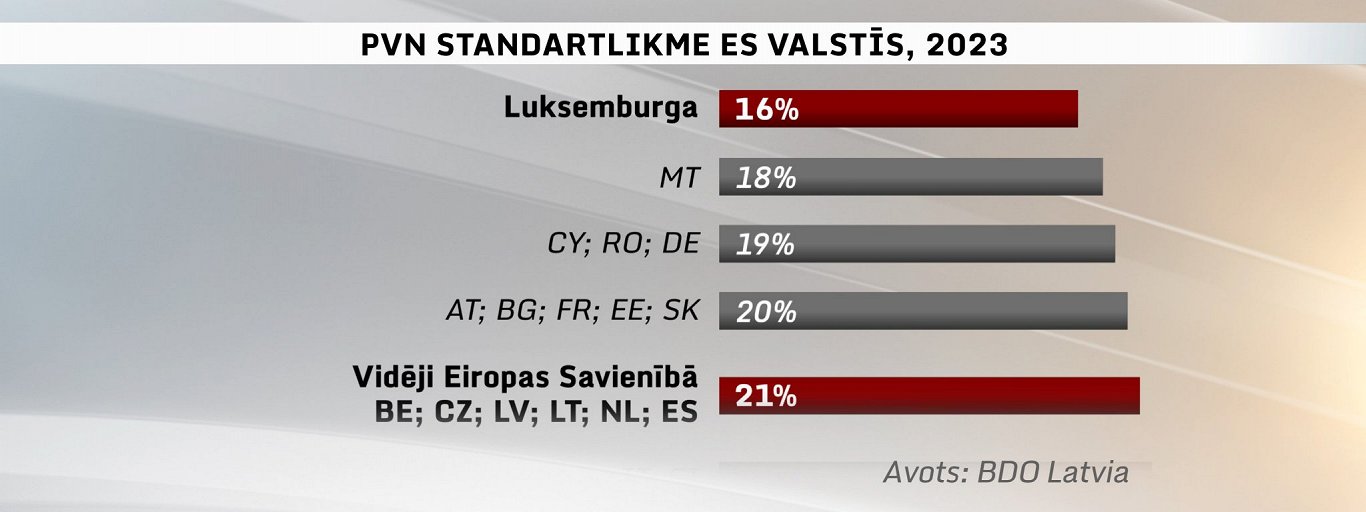

The EU VAT Directive provides that the standard rate of this tax may not be less than 15%.

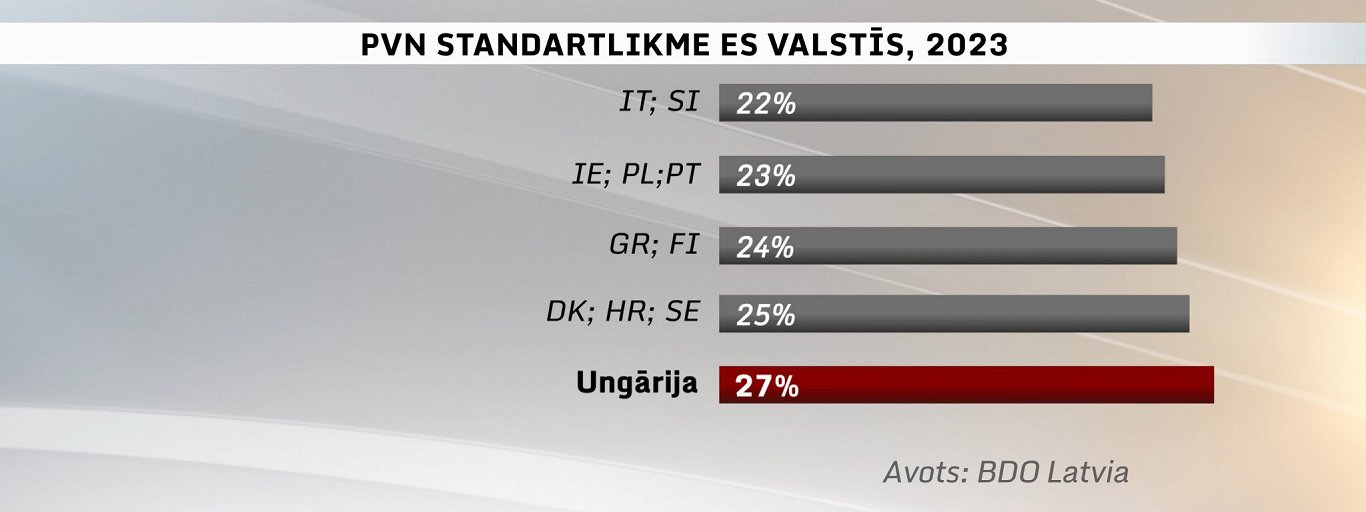

The lowest rate among EU Member States is in Luxembourg – 16%, while the average rate in the EU is 21%, which is also Latvia's choice. Hungary has the highest rate at 27%.

Jānis Taukačs, partner of the Sorainen law firm, compared the tax system to bees and honey: "That beauty of the tax system, I think, is like taking honey from a flower for a bee without hurting the flower. And VAT inherently takes some sort of particle from each stage of the product or service during each stage of production. If the system works perfectly, then of course everyone has paid almost without noticing that little bit of it, and it's all right overall."

In order to cause as little damage as possible, reduced rates are applied to VAT. The directive allows Member States to introduce reduced rates of VAT, one not higher than 12% and the other not lower than 5%. However, it should be noted here that there is also a list of certain goods and services, such as health and hygiene products, passenger transport and, among other things, food, for which an even lower rate can be set. So this issue of reduced rates is up to national leadership.

For the most part, they are allocated to support local producers and the disadvantaged. However, industry professionals stress that often this reduction in the VAT rate does not reach the consumer at all. One of the reasons is that it stays with traders.

"Even if these traders are cutting prices, then that too falls short of their target because a large proportion of buyers are wealthy people.[..] Therefore, there are other mechanisms both through benefits and through, for example, the same non-taxable part of personal income tax, there is an opportunity to support this target audience, the low-income population, pensioners and the like," said Taukačs.

Moreover, reduced VAT rates lead to quite a number of disputes.

In Latvia there is a conflict over canceling the reduced rate of 5% for vegetables and fruits grown in Latvia. They were scheduled to be re-charged with a standard 21% rate from January 1, but as a result of industry pressure, the government nevertheless backed the application of a 12% rate for one year. This will cost the country €16 million, which the government hopes will compensate by raising another - the excise tax rate. The industry is still unhappy.

If compared with neighboring Lithuania and Estonia, the situation is similar, at least when it comes to rates.

Differences in VAT standard and reduced rates are not too great, even if it is taken into account that Estonians plan to raise the standard rate. Lithuania, for example, has two reduced rates, but none applies to food.

However, most, especially the wealthiest EU countries, where the standard of living of the population is higher, apply a lower VAT rate to food and to a wider group of products. In Germany, for example, it is 7%, in Luxembourg it is only 3%. In Ireland, most foods are not subject to VAT at all.

Last year, revenues from VAT in Latvia's state budget had risen to 3.5 billion euros, almost 3.8 billion euros were forecast this year and more than 4 billion euros next year. However, after applying the VAT rate for fruit and vegetables in the amount of 12% instead of 21%, revenues from this tax will be 16 million less, the Ministry of Finance has predicted.

Researchers stress that counting on such income is reckless. The higher the VAT rate, the greater the temptation for entrepreneurs to keep some of the money in their pocket. The fruit and vegetable industry concerned in Latvia has also repeatedly expressed worries that a higher VAT rate on produce will lead to shadow economy.