The government coalition parties agreed earlier that the social insurance contributions will be raised by 1 percentage point – 0.5 percent for contributions paid by employers, and 0.5 for employees. So in the future, mandatory social insurance contributions will amount to 35.09 percent – 24.09 percent paid by the employer, and 11 percent paid by the employee.

Increase of the mandatory social insurance contribution will generate an additional EUR 84.6 million for the health care sector next year, EUR 98.1 million in 2019, and EUR 103.9 million in 2020, according to government projections.

The amendments also provide that employees for which the general mandatory social insurance contribution is made, will be subjects to health insurance and will have the right to receive government-funded health care services.

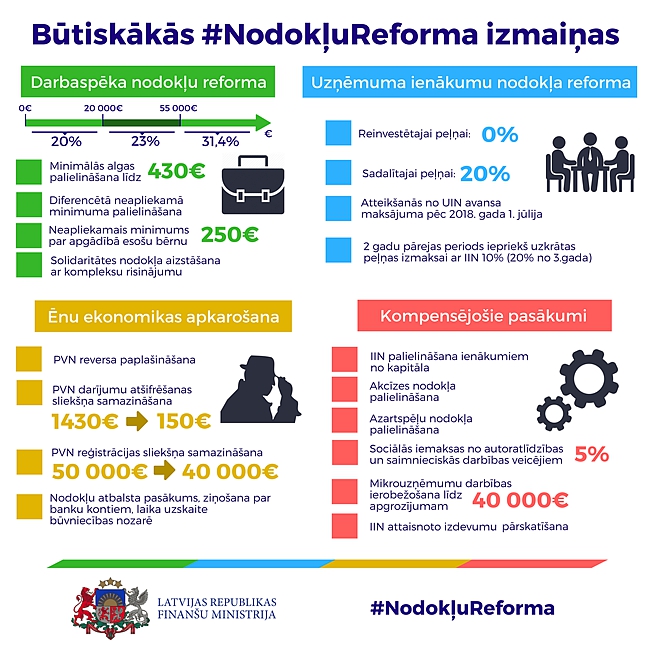

Uzzini visas būtiskākās #NodokļuReforma izmaiņas vienuviet! Vairāk par reformu: https://t.co/dpgeHD5BDs pic.twitter.com/SZmeOsiT7s

— Finanšu ministrija (@Finmin) July 11, 2017

The decision has not been made about other socially insured people who pay labor taxes in a special regime and about those for whom social insurance contributions are not made due to objective reasons, including pensioners, children and other groups.

Prime Minister Maris Kucinskis on July 5 gave a task to Health Minister Anda Caksa in cooperation with the Finance Ministry, the Welfare Ministry and other responsible institutions, social partners and NGOs to prepare a bill on health care financing and submit it to the Cabinet of Ministers by August 30.

The Cabinet of Ministers on July 11 revised the remaining bills related to tax reform – amendments to the Law on Personal Income Tax, the Law on Solidarity Tax, the Law on Excise Tax, the Law on State Social Insurance, the Law on Corporate Income Tax, and Micro Enterprise Tax Law.

After the government adopts the amendments, they will be sent to Saeima which might adopt the bills in their second reading on July 21.

Income Tax

The Cabinet of Ministers also approved amendments to the Law on Personal Income Tax that stipulate differentiation of the tax from January 1, 2018.

At the moment, personal income tax is 23 percent across the board. Starting January 1 next year, a 20 percent rate will apply to annual incomes up to EUR 20,000, a 23 percent rate will apply to annual incomes from EUR 20,001 to EUR 55,000, and a 31.4 percent rate to annual incomes of over EUR 55,000.

The 31.4 percent tax rate will not apply to employee income during the taxation year. The disburser of the income will deduct 23 percent of monthly income amounts in excess of EUR 1,667. Annual incomes higher than EUR 55,000 will be taxed according to summary procedures.

A single 15 percent income tax (differentiated 10 percent and 15 percent at the moment) will apply to income from capital increase.

Personal income tax will now also apply to lottery and gambling prizes larger than EUR 3,000, except the Centennial Lottery prizes.

The amendments also deal with life insurance premium amounts, employers' gifts, amounts of tax-exempt healthcare and education services for taxpayers and their family members, capital gain tax rates, and others.

The non-taxable minimum for pensioners will be increased to EUR 250 a month next year, to EUR 270 in 2019 and EUR 300 in 2020.

.@Brivibas36 atbalsta nodokļu reformu. Premjers sola iedzīvotājiem stabilitāti un izaugsmi. https://t.co/8YGj1eaIRW pic.twitter.com/91g7GWb2tP

— LTV Panorama (@ltvpanorama) July 11, 2017