On Tuesday, the National Economy Commission of the Saeima will discuss the impact of the increase in Euribor rates on the national economy. The European Central Bank's rate hike is aimed at taming inflation, but it could have a dramatic effect on mortgage borrowers with long-term and demanding payments to make, Indriksone said.

The fear is that, unable to pay their bills at home, workers will have little option but to seek better-paid work in other countries, which in turn would accentuate skills and labor shortages in Latvia as well as reducing tax revenues.

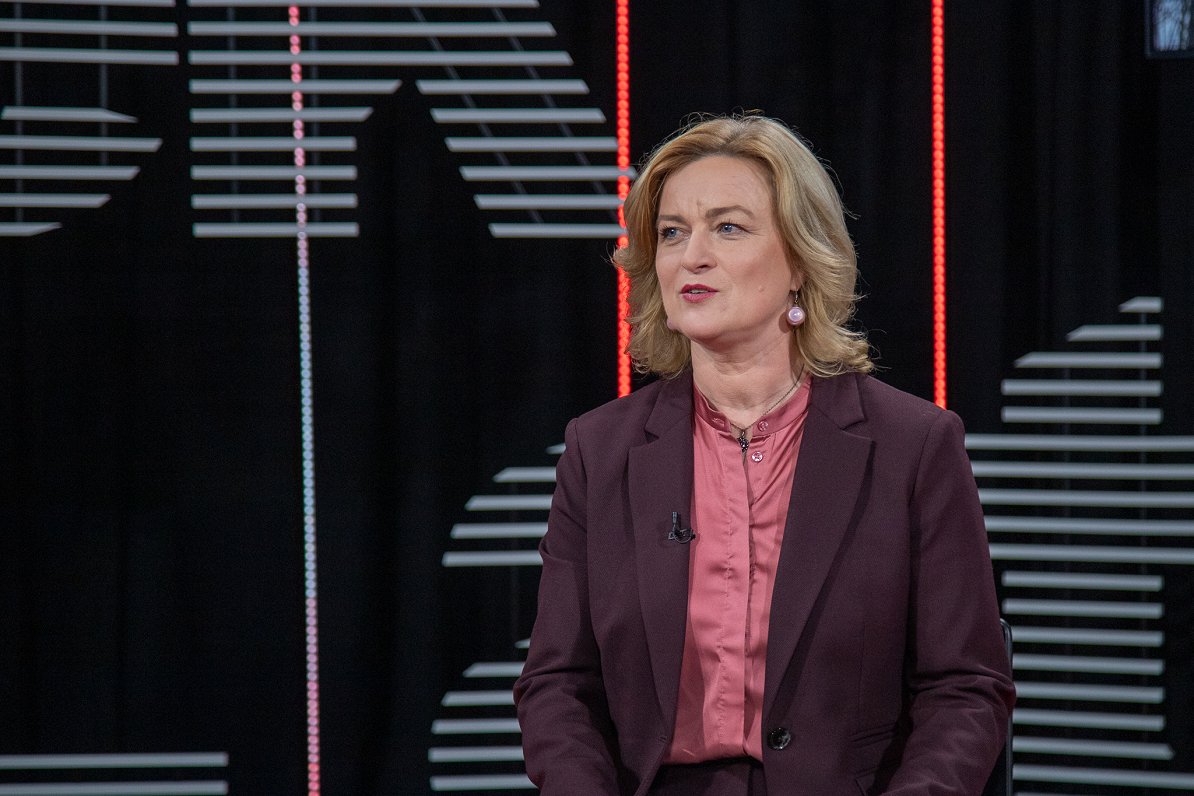

"We definitely don't want to experience another wave of economic emigration, when people couldn't pay their bills and left Latvia," said Indriksone, referring to earlier economic exoduses like the one of the early 2000s which saw more than 10% of the population pack up and leave in search of jobs.

The minister said she believes that credit institutions themselves should primarily assess the rise in rates and their impact. However, the state can get involved in this regard by applying a surplus profit tax to banks, which in Indriksone's view would be a suitable solution.

"If we take additional money from the banks, then it should go in the direction from where it was obtained. It is certainly additional programs of [state-run development bank] Altum to improve investments, the level of lending in the household sector is also very low," said Indriksone.

At the beginning of August, the chairman of the Saeima's Budget and Finance (Tax) Commission, former Finance Minister Jānis Reirs (New Unity), stated that the Euribor interest rate is being unjustifiably applied to mortgage loans, so that certain banks can make huge profits.

This in turn caused criticism from representatives of the banking sector, who were skeptical of the former finance minister's understanding of the fundamentals of the financial system.

Reirs had previously also stated that those banks which, in addition to their fixed interest rates, also apply the Euribor interest rate to mortgage loans, are actually engaged in unfair business.

Representatives of the Latvian central bank – which in turn is one of the members of the European Central Bank which sets the Euribor rates – said that linking loans to Euribor rates is not unfair.