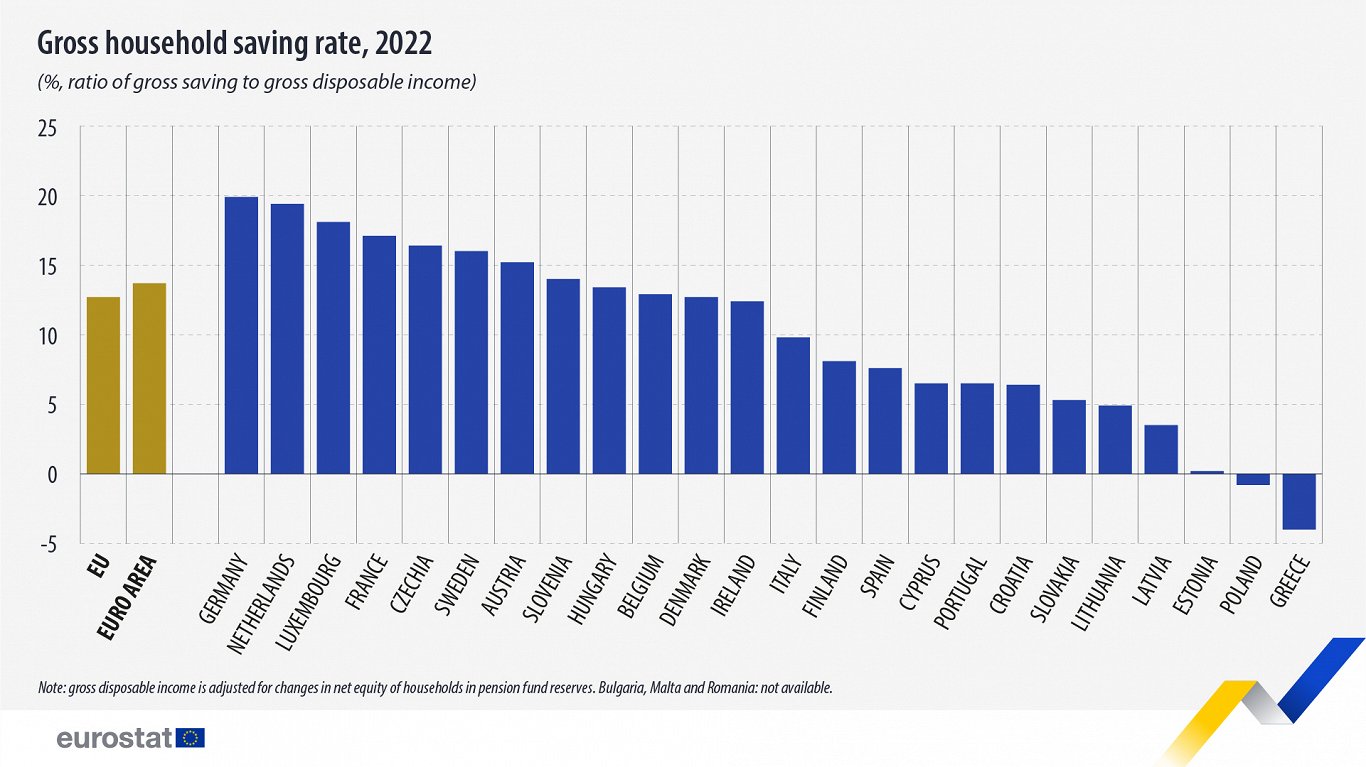

On average, Latvian residents put aside 3.48% of their disposable income – just one quarter of the EU average. In Lithuania the equivalent rate was slightly higher at 4.85%, while in Estonia it was even lower at just 0.15%. In fact, of the EU countries that did register a positive saving rate, the three Baltic states recorded the lowest rates.

In 2022, people in the EU as a whole saved on average 12.7% of their disposable income. The rate was significantly lower than in 2021 (16.4%), and closer to the values before COVID-19 pandemic. The highest gross saving rates among the EU members in 2022 were recorded in Germany (19.9%), the Netherlands (19.4%) and Luxembourg (18.1%).

12 EU members recorded saving rates below 10.0% in 2022, among which Poland and Greece had negative rates, -0.8% and -4.0%, respectively. This indicates that households spent more than their gross household disposable income and were therefore either using accumulated savings from previous periods, or were borrowing to finance their expenditure.

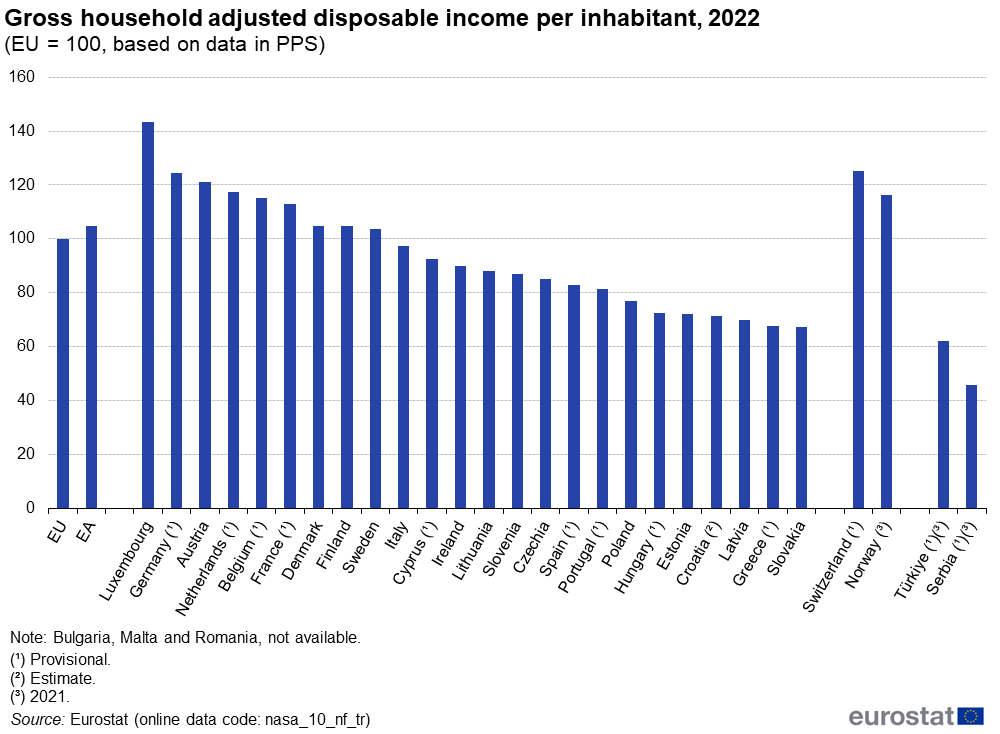

In 2022, real gross household adjusted disposable income per inhabitant in the EU recorded a decrease of 0.8%, while the euro area experienced a 0.9% drop, the first declines since 2013.

"In 2022, net wages and gross operating surplus and mixed income together accounted for 73.6 % of disposable income in Denmark, 72.1 % in Ireland, 66.9 % in Latvia and 66.2 % in Estonia. By contrast, this share was under half of the total in Germany (47.8 %). Net wages were valued 8.2 times as high as the gross operating surplus and mixed income in Sweden, 5.7 times as high in Denmark and 4.9 times as high in Estonia. By contrast, in Poland and most notably in Greece, the value of the gross operating surplus and mixed income was greater than the value of net wages," said Eurostat.

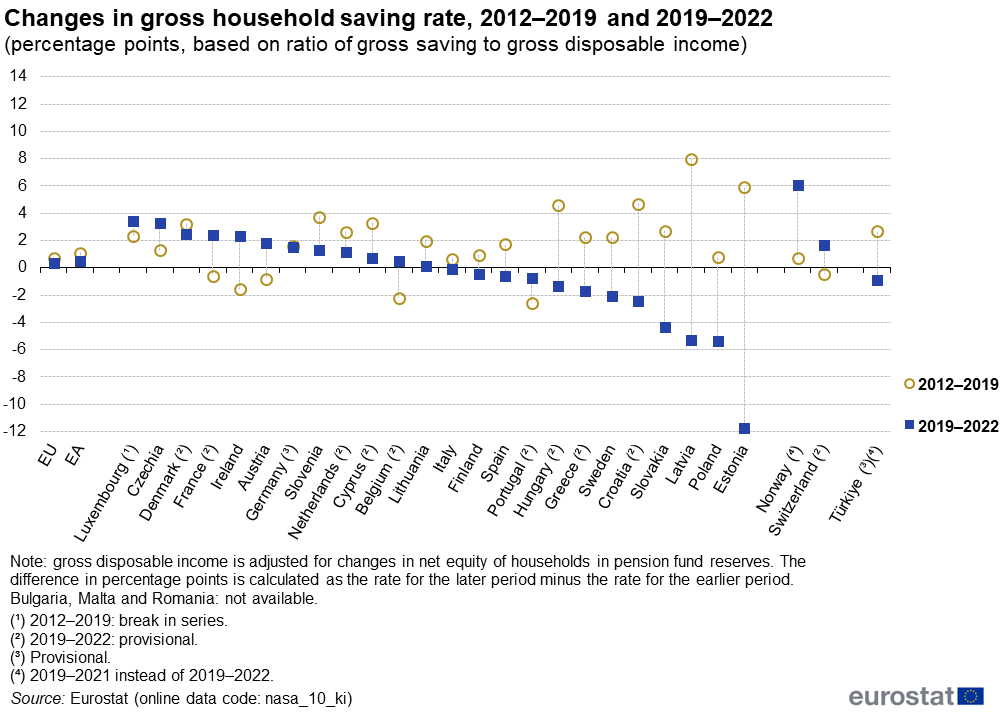

The figures suggest that Latvians' steadily increasing savings habit has been shaken by the intervention of the Covid crisis. Latvia recorded the largest overall increase in its household saving rate between 2012 and 2019, up 8.0 pp. However, in the period 2019-2022, the household saving rate has fallen back by 5.0 pp.