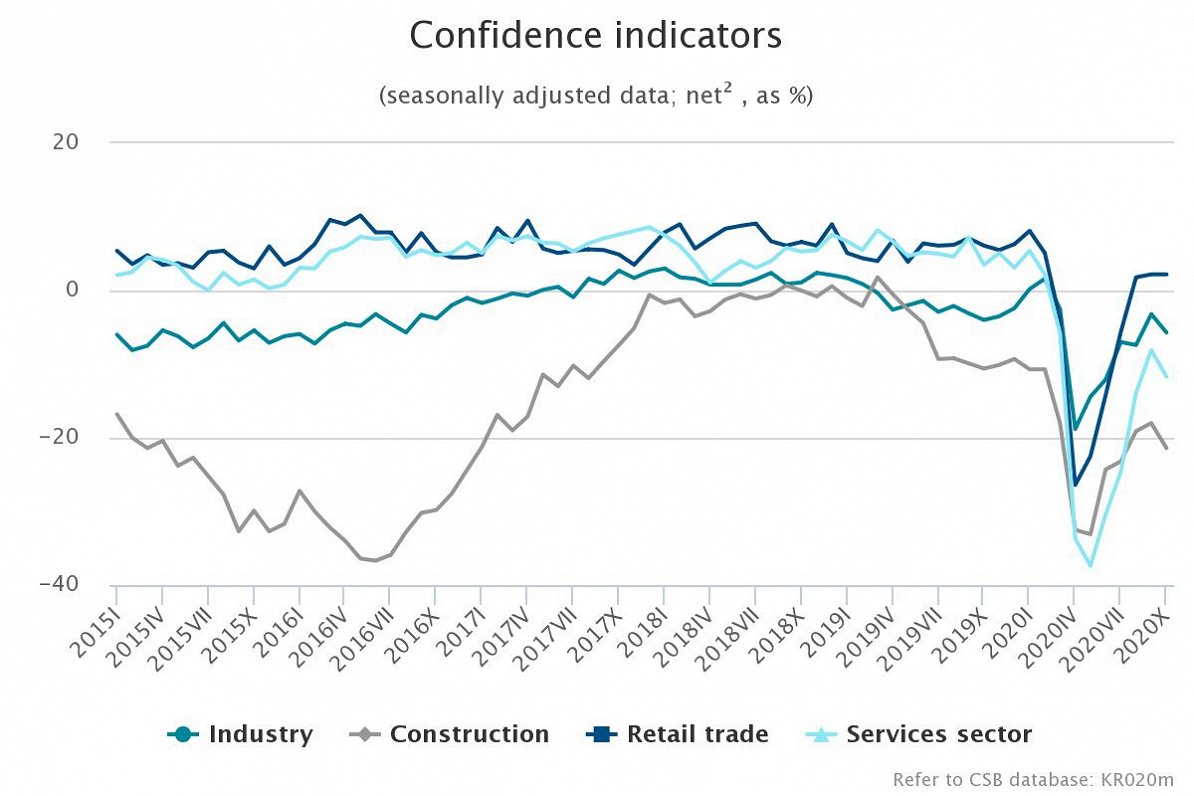

Business confidence indicators characterize the general situation in the sector, and they are acquired by carrying out business surveys in industry, construction, retail trade and services sectors. If the indicator is above zero, business environment is positive, if it is below zero, business environment is negative.

Retail trade remains positive for third consecutive month

According to seasonally adjusted data, in October the confidence indicator in retail trade comprised 2.2, which is the same as in September (1.8 in August). As situation in business continued to improve, confidence indicators in retail trade of food products were positive and even slightly exceeded indicator of October last year. Also in retail trade of non-food products business environment in October has been positive, even though slightly lower than in the corresponding period of the previous year. Confidence indicators in trade of motor vehicles, motorcycles and their parts and accessories, as well as repair of motor vehicles and retail trade of fuel were negative, and their values were more negative than in October last year.

In October, main factor restricting economic activity in retail trade, the same as before outbreak of COVID-19 at the beginning of the year, still is competition in trade sector that was mentioned by 43 % of respondents. It is followed by insufficient demand (25 %) and impact of COVID-19 on the business in retail trade sector (24 %). Significance of this factor continued to reduce. This is more than two times less than in April, when maximum value of 54 % was reached, and 3 percentage points less than in July. In October, 28 % of retail sellers felt no factors restricting economic activity.

Services sector confidence indicator drops

In the services sector in October 2020, according to seasonally adjusted data, confidence comprised -11.7. As compared to September, this indicator has dropped by 3.6 percentage points. In several services sectors confidence indicators, compared to September, reduced significantly, for example, in catering indicator fell by 24.3 percentage points, reaching negative value -20.0. Significant drop, compared to September, was also observed in insurance sector, as well as in rental and leasing services sector (of 14.5 percentage points in both sectors). The lowest confidence indicators are still in travel agency and tour operator and air transport sectors. In turn, business environment in computer programming, as well as in postal and courier activities is positive and continues to improve.

In October, 40 % of respondents of services sector have not felt any factor restricting economic activity, which is the highest indicator since January this year, but 33 % of respondents still indicated that consequences from COVID-19 is a significant factor restricting successful economic activity. Value of this indicator is almost the same as in July. 29 % of services sector respondents indicated that economic activity was significantly restricted by insufficient demand. Lack of labour force, which since April has lost its importance, is mentioned as a restrictive factor only by 5 % of respondents.

Construction sector confidence down, too

As compared to the previous month, in October of this year confidence indicator in construction fell by 3.4 percentage points, dropping to -21.4, which was affected by even larger decrease in assessment of level of construction orders and negative assessment of entrepreneurs regarding expected employment in the next three months. Confidence indicator reduced in all construction sectors – construction of buildings, civil engineering and specialized construction activities.

As compared to September, in October the number of respondents indicating insufficient demand (35 % of construction enterprises surveyed), as well as impact of weather (11 % of enterprises surveyed) out of all factors affecting economic activity of construction enterprises has slightly increased, and the number of enterprises indicating impact of COVID-19 as a restrictive factor has increased by 4 percentage points (10 % of respondents). However, the number of enterprises indicating lack of labour force (12 % of construction enterprises surveyed) and financial difficulties (14 % of respondents) as a restrictive factor has slightly reduced. More than a year ago construction enterprises feel insufficient demand and financial difficulties (of 7 and 2 percentage points, respectively), but less – impact of weather (of 6 percentage points) and lack of labour force (of 10 percentage points). In October, economic activity of 33 % of construction enterprises was not affected by any restrictive factor.

Manufacturing sector confidence dips by 2.5 percentage points

In October confidence indicator in manufacturing comprised -5.7 (2.5 percentage points less than in September), and it was affected by even more negative assessment of company managers regarding current level of orders and their forecast about own enterprise's activity for the next three months (expected fall in the production activity, fall in assessment of economic activity). The largest drop of confidence indicator, compared to the previous month, was in such manufacturing sectors as manufacture of basic pharmaceutical products and pharmaceutical preparations, manufacture of textiles, printing and reproduction of recorded media, manufacture of wood and of products of wood and cork, manufacture of machinery and equipment n.e.c. As compared to September, business environment worsened regarding expected sale price of goods and development of employment in the following months.

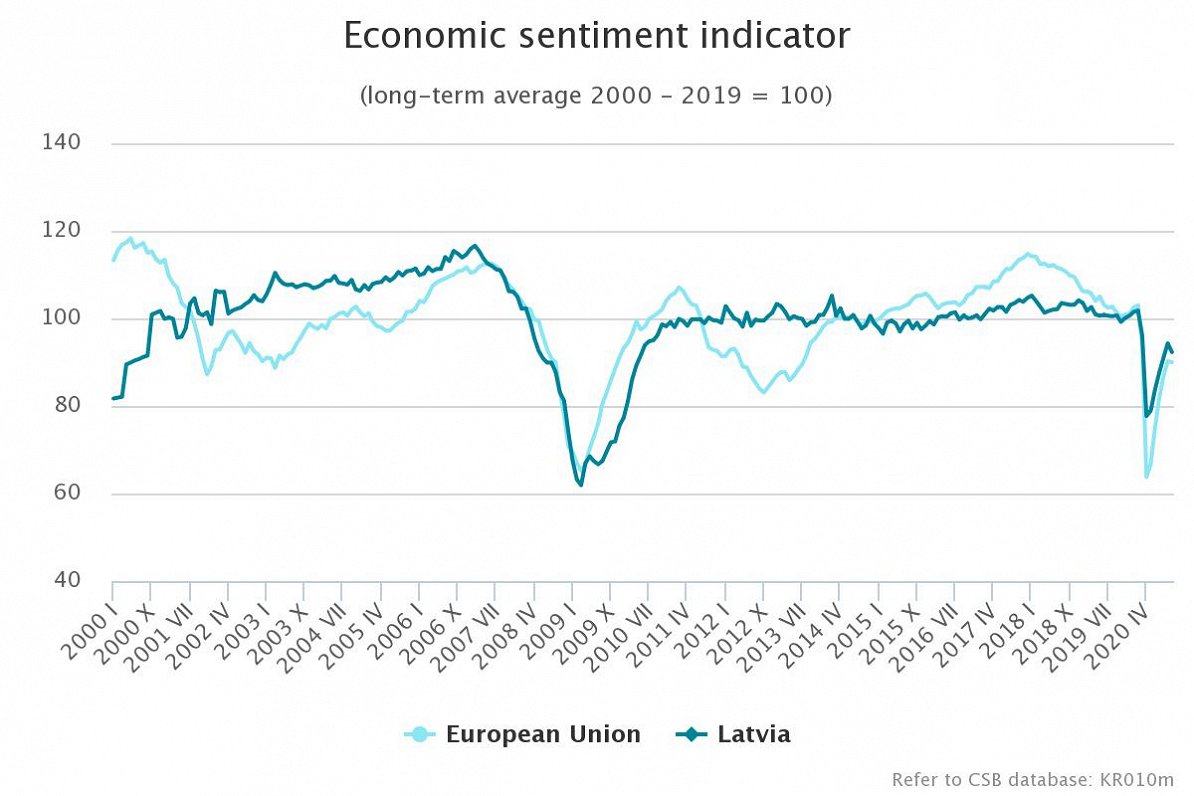

In October 2020 the economic sentiment indicator comprised 92.3, which is 2.0 points less than in September. Economic sentiment indicator characterizes general socio-economic situation in the country during a certain period of time (month), and it is calculated by the European Commission, Directorate-General for Economic and Financial Affairs for all EU countries according to a common methodology, taking 15 various seasonally adjusted components included in industry, construction, retail trade and services sector, as well as in consumer confidence indicator, as a basis.