The government has viewed amendments to the value added tax (VAT) law in order to temporarily introduce domestic VAT rates of 0 per cent for the supply of COVID-19 vaccines and COVID-19 in vitro diagnostic medical devices and services closely related to such vaccines and devices until 31 December 2022.

FM explained that VAT is a harmonized tax in the European Union (EU), so that the rules on VAT rates are regulated at EU level and Member States do not have the right to introduce VAT rates for the supply of goods or services that are not specifically covered by the so-called VAT Directive. While the current VAT rules allow for a partial reduction in the cost of COVID-19 vaccines and tests, they do not allow the application of the VAT 0 per cent rate for such vaccines and their closely related services. Nor do they allow VAT to be reduced or VAT 0 per cent for “in vitro” diagnostic medical devices, including closely related services.

In order to allow Member States to introduce appropriate VAT reduced rates and reduce medical care costs, thereby making it more accessible to citizens, the European Commission proposed to amend the VAT Directive as regards provisional measures for VAT COVID-19 vaccines and COVID-19 “in vitro” diagnostic medical devices. On 11 December this year, the relevant amendments to the provisional measures relating to VAT applicable to COVID-19 vaccines and in vitro diagnostic medical devices have been published.

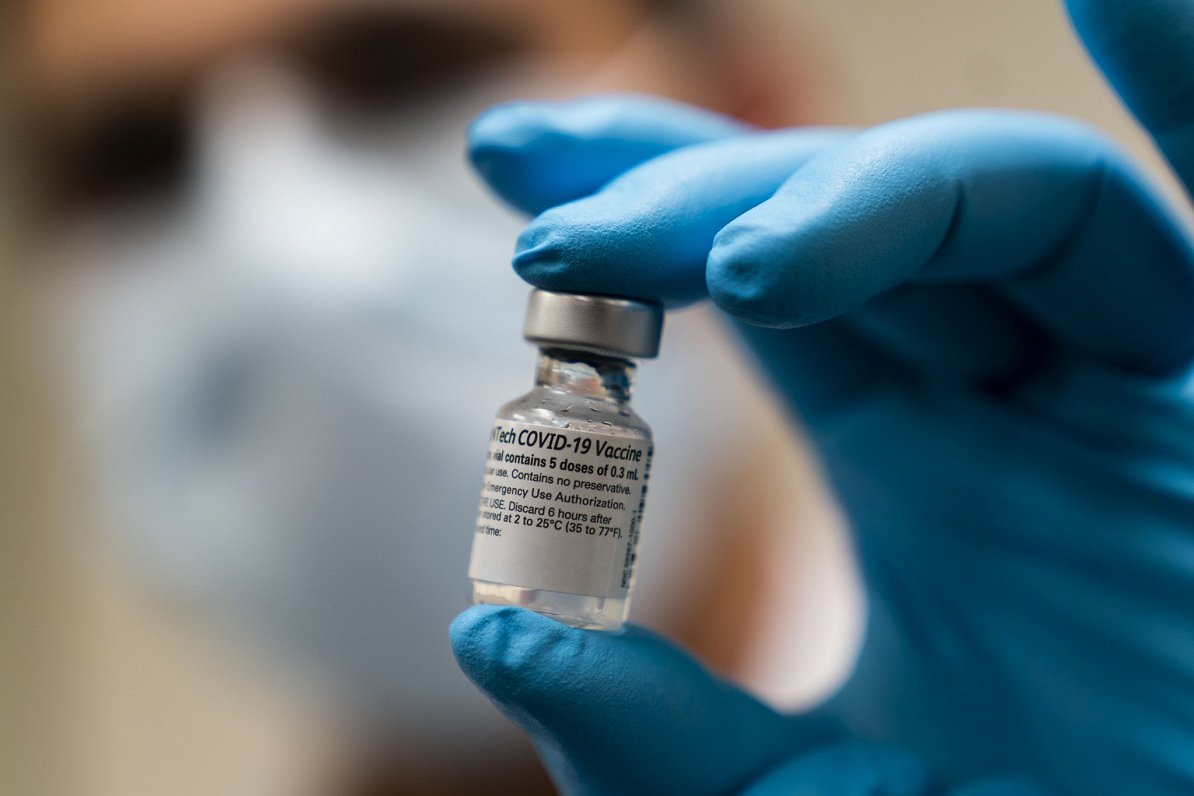

In Latvia, vaccines are already subject to a reduced VAT rate of 12%. In order to achieve the objective of reducing medical care costs and making COVID-19 vaccines more accessible to the population, amendments to the VAT Law encourage the possibility of introducing a VAT 0 per cent rate for both COVID-19 vaccines and COVID-19 in vitro diagnostic medical devices and services closely associated with these vaccines and devices.

According to the FM, given the urgency of the situation associated with the COVID-19 pandemic, the above-mentioned directive should be taken over in Latvia as soon as possible and in line with the situation of Latvia. This would provide timely access to supplies of COVID-19 vaccines and COVID-19 in vitro diagnostic medical devices at a more proportionate cost.

Amendments to the law will be decided on by the Saeima.