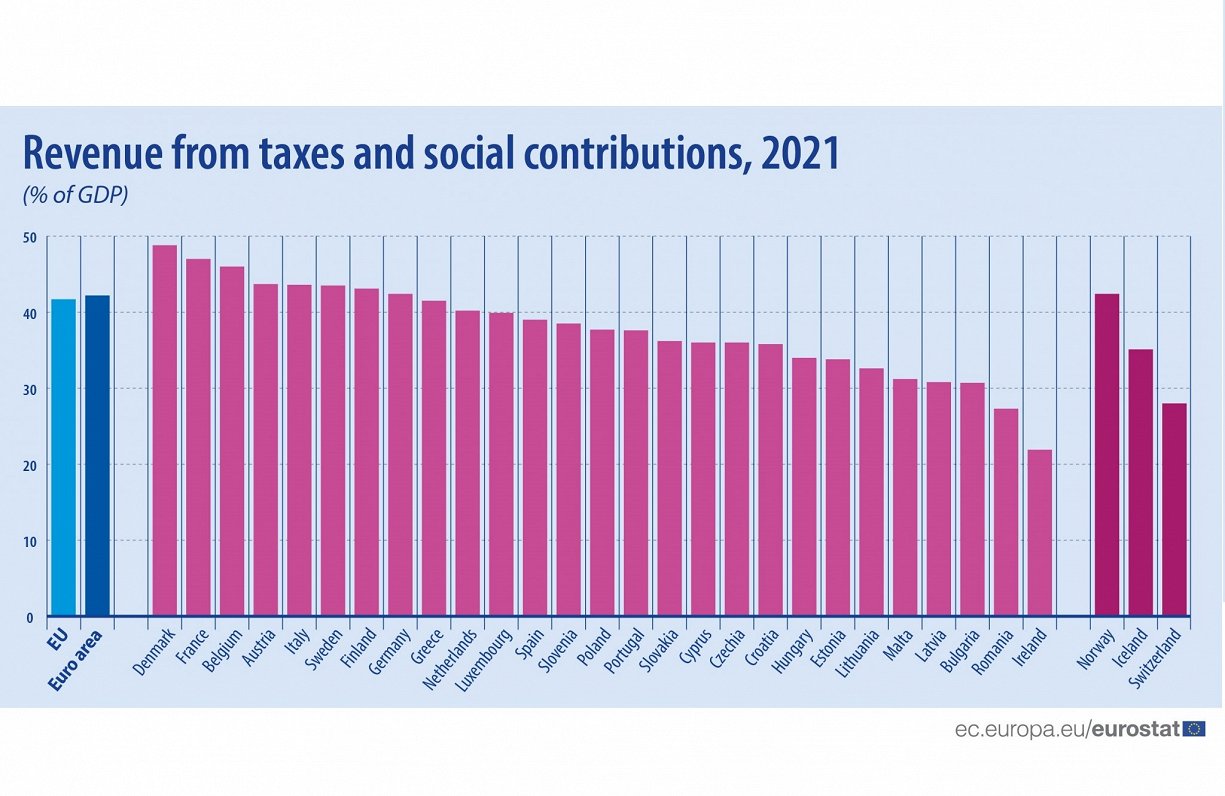

The tax-to-GDP ratio varied significantly between Member States in 2021, with the highest shares of taxes and social contributions as a percentage of GDP being recorded in Denmark (48.8%), France (47.0%) and Belgium (46.0%).

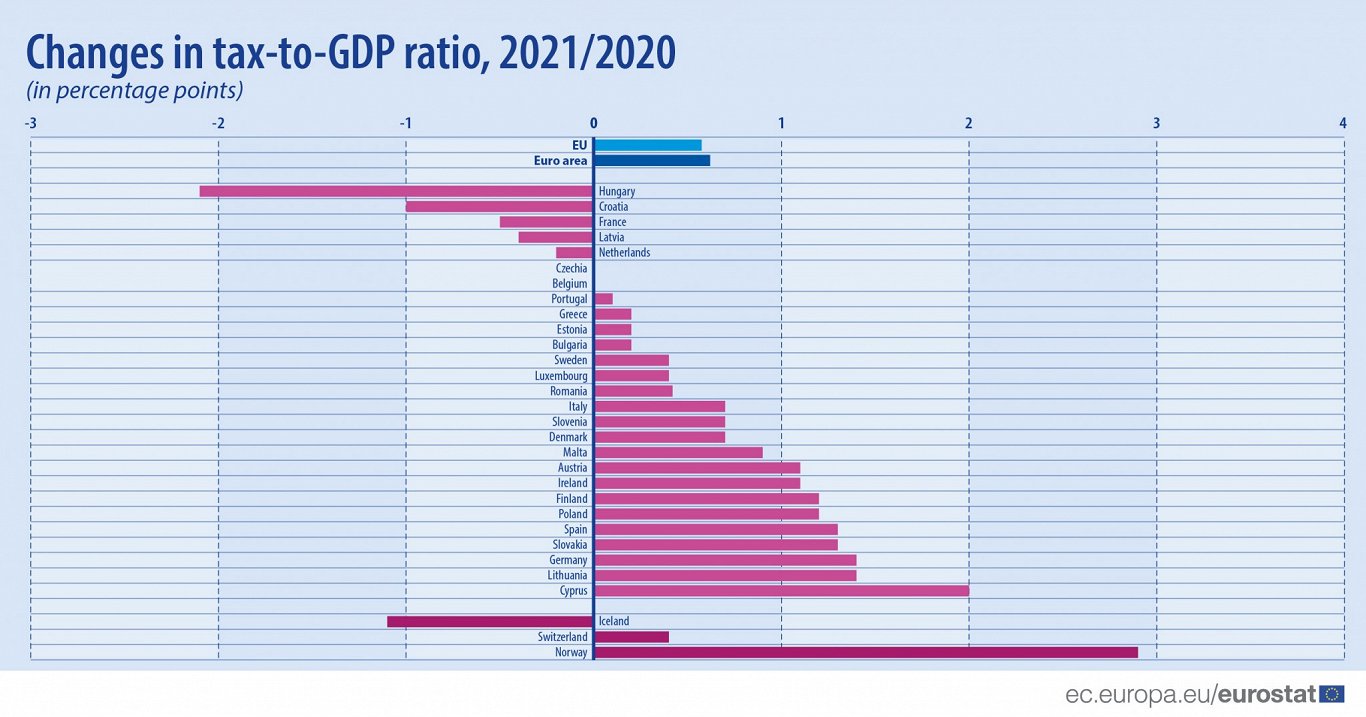

At the opposite end of the scale, Ireland (21.9%), Romania (27.3%), Bulgaria (30.7%) and Latvia (30.8%) registered the lowest ratios. Latvia was also one of only five EU countries to see a decrease in this metric from 2020 to 2021.

As a ratio of GDP, in 2021 tax revenue (including net social contributions) accounted for 41.7 % of GDP in the European Union (EU) and 42.2 % of GDP in the euro area (EA-19).