The total volume of non-cash payments edged down for the first time. At the same time, the share of non-cash payments in the total volume of payments is gradually increasing.

The "Payment Radar" data contains the latest information on money usage habits of Latvia's households, businesses and the public at large and is available on Latvijas Banka's website (https://www.bank.lv/en/tasks/payment-systems/payment-radar).

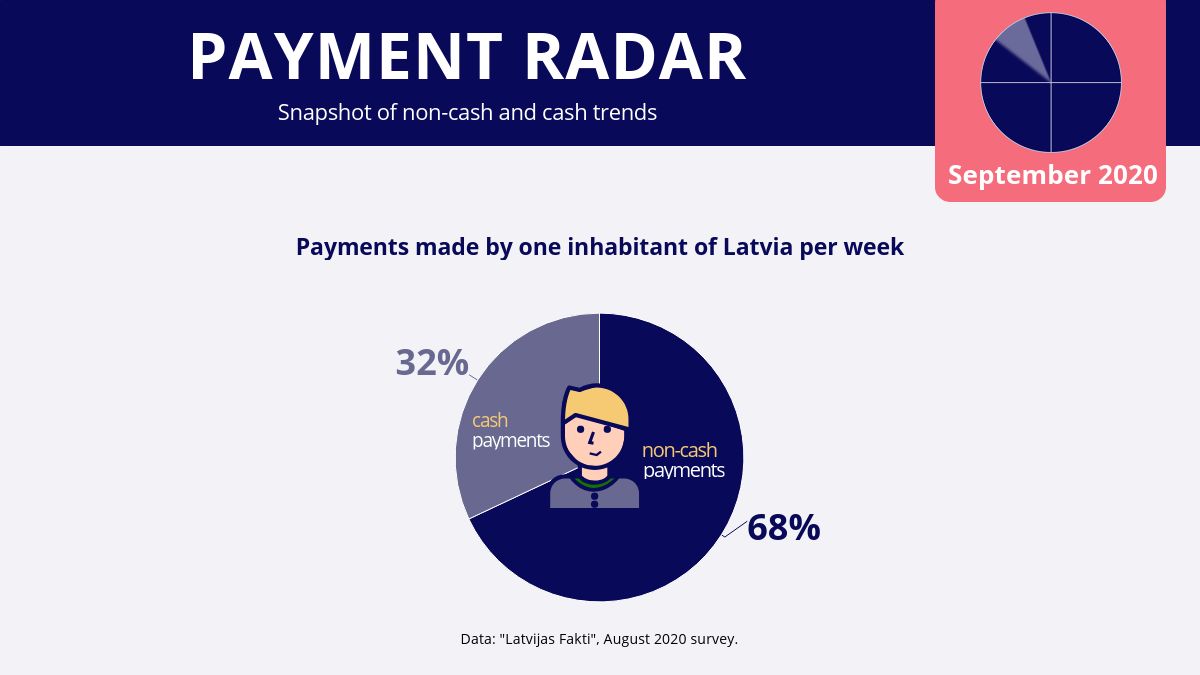

The latest edition of the "Payment Radar" suggests the share of non-cash payments in the total volume of payments is gradually picking up; the proportion of cash and non-cash payments made by one inhabitant of Latvia constitutes 32% and 68% respectively (in February 2020 it was 36% and 64% respectively);

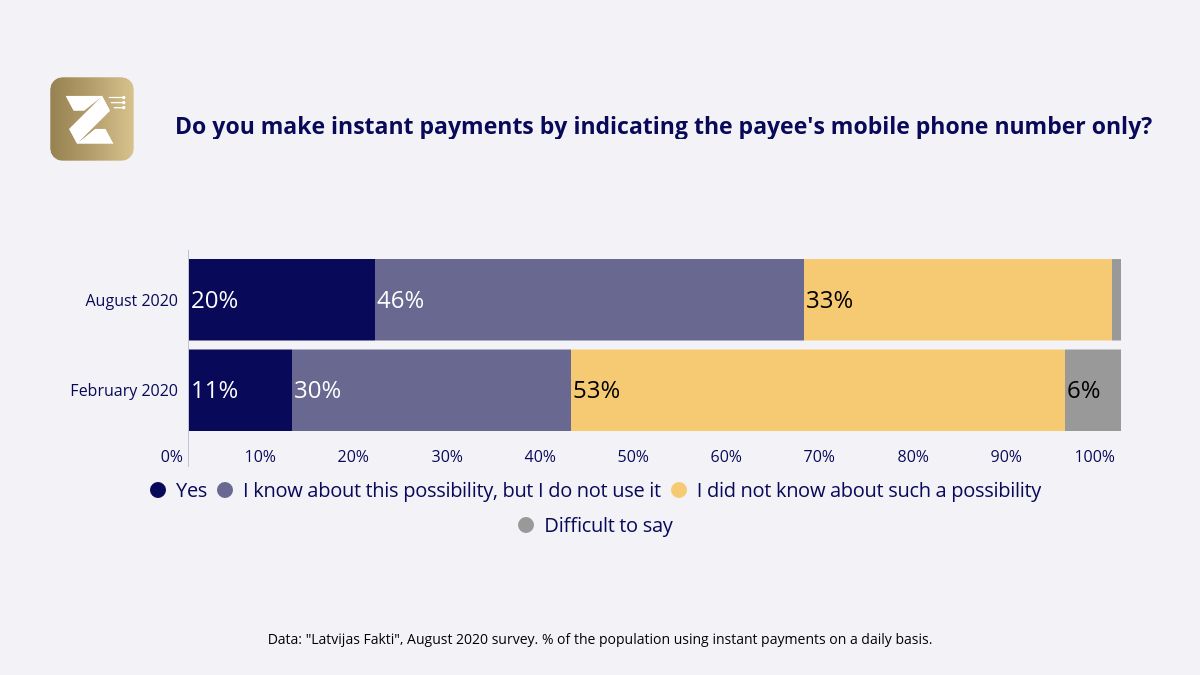

Both the popularity of instant payments and the use of instant links have followed an upward path; 20% of instant payment users made instant payments by indicating the payee's mobile phone number only in August 2020 (11% in February 2020), but 46% of the population knew about this service (30% in February 2020).

The number of registered instant links has exceeded 235 thousand, and this service has been provided not only to the leading banks of Latvia but also to Estonian commercial banks via Latvijas Banka's infrastructure.

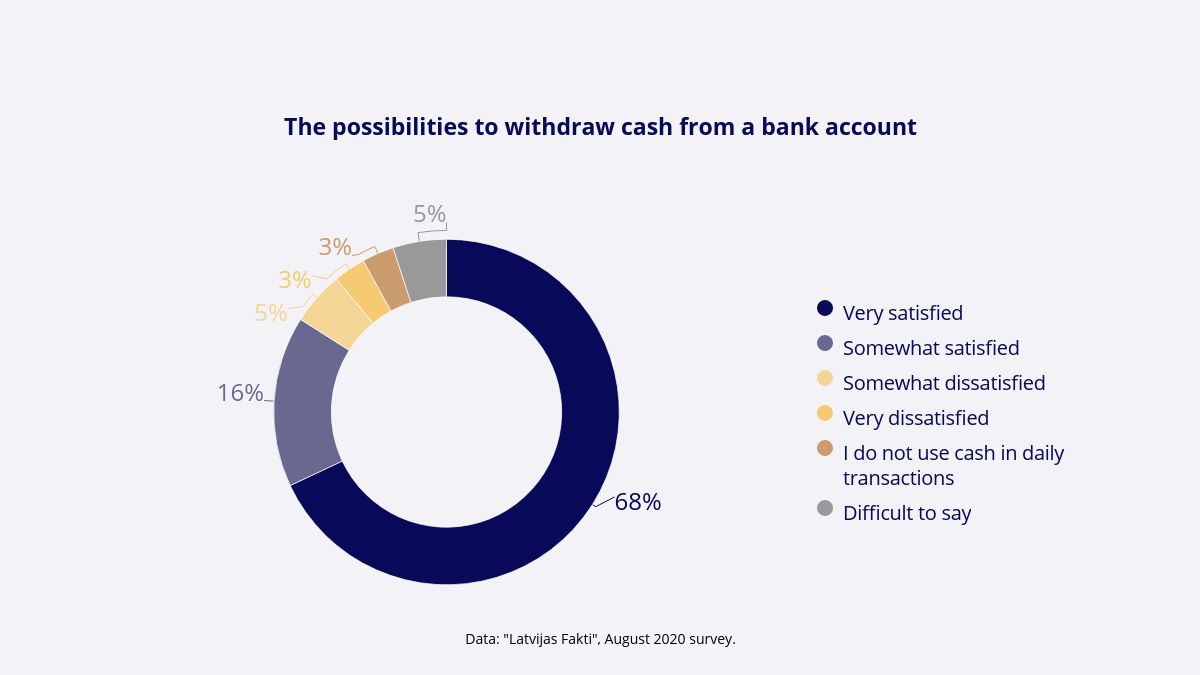

The number of people who take the view that low denomination coins – 1 cent and 2 cents – should be withdrawn from circulation has risen (43% of the surveyed population expressed such a view in August 2020 vis-à-vis 27% in February 2020); the number of people who believe that 1 cent and 2 cent coins should remain in circulation is still stable (49% in August and 46% in February). Overall the population is satisfied with the availability of cash (84% of those surveyed); however, a relatively high proportion (8%) of the respondents were somewhat dissatisfied or very dissatisfied with the opportunities to withdraw cash from their current accounts.

"The first half of the year has been defined by the Covid-19 pandemic. It has affected virtually all aspects of our daily life, and payments are no exception. For the first time, the total volume of payments recorded a decrease instead of following an upward trend evident over the most recent years," said Deniss Fiļipovs, Head of the Payment Systems Policy Division of Latvijas Banka.

"For the first time, the total volume of payments recorded a decrease instead of following an upward trend evident over the most recent years. In the first half of 2020, the card payments which are the most popular among the population dropped by 6.1% in the number of transactions as compared to the second half of 2019. At the same time, the credit transfers dominating in terms of volume decreased significantly: with the economic activity contracting sharply, the total volume of payments dropped by 14.8% in the first half of the year in comparison with the second half of 2019.

"In the express survey of the social media users conducted recently by Latvijas Banka, less than half of the respondents clearly stated that overall, the COVID-19 pandemic had not affected their spending habits. Almost one-third of the respondents noted that they shop less frequently, whereas another one-third of the respondents reported changes in their spending habits, pointing to a more active use of payment cards and the use of the Internet for remote purchases," Fiļipovs said.

"With the impact of the COVID-19 pandemic weakening and the situation normalising, the growth in the volume of non-cash payments is expected to resume. However, the developments of the most recent months have contributed to changes in the spending habits of the population. This should be borne in mind by both the non-cash payment service providers to make their services more attractive, convenient and safer for consumers and the provider of the payment infrastructure – Latvijas Banka," Fiļipovs added.