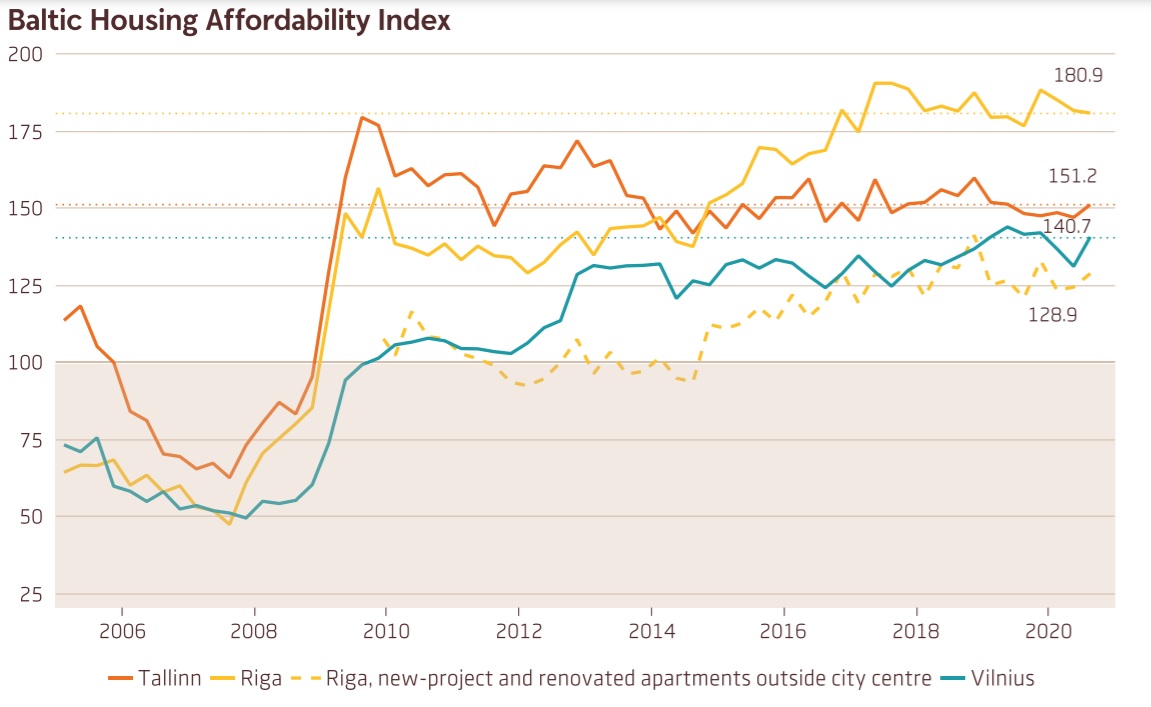

"Housing affordability remained high throughout the three quarters of 2020. In the third quarter, housing affordability increased in Estonia (+2.8) and Latvia (+4.1), while decreasing in Lithuania (-0.9), compared with the same quarter last year," Swedbank said.

"In Estonia, mortgage loan fee discounts by banks were significant enough to improve housing affordability, although apartment price growth slightly exceeded net wage growth. Meanwhile, the Latvian market continues to experience higher wage increase than average apartment price growth. The index dip in Lithuania is still caused by the growth of apartment prices exceeding that of average household income," Swedbank added.

In Riga, prices increased by 0.8% in the third quarter -- nearly unchanged growth from the second quarter. However the third quarter also saw a 9.4% drop in transactions, mainly due to the secondary market. In September transactions in Soviet-era apartments bounced back, exceeding last year’s level. Market activity continued to revive in Latvia in October.

"'The sales of recently finished new-project apartment buildings provide a promising outlook for transaction growth in the primary market, which will support price growth in the final quarter," Swedbank said, predicting that "the worst is over" in the housing market, at least.

"In Latvia, the more virus-sensitive secondary market is likely to have a negative effect on total transactions during the second wave, which will be somewhat mitigated by increasing sales of newly built apartments. The larger expected share of newly built apartments in the total number in the fourth quarter will support the average price," the bank said.

"Despite fears at the start of the pandemic, housing prices did not drop in the Baltic capitals. The effects of the second wave and resulting dent in transactions in the secondary market may cause a dip in housing market activity at the end of the year. However, prices are not expected to suffer, in part because the more expensive primary market is so far brushing off the crisis. With the vaccine in sight and households getting used to living in times of a pandemic, homeowners are unlikely to make rash, panic driven decisions; therefore, the housing market is likely to react even less to the pandemic than in the spring," Swedbank concluded.

The full report can be read online.