The Russian Federation is now the largest source of foreign investment capital in Latvia, this year chalking up a total of 246 investments, said Kiopa. Italy made a surprising showing in second place, with Italians investing as co-owners of various Latvian enterprises, despite not having shown much interest in previous years. Neighboring Lithuania and Estonia took third and fourth place, respectively, while Ukraine came in fifth place as a new leading source of investment capital for Latvia.

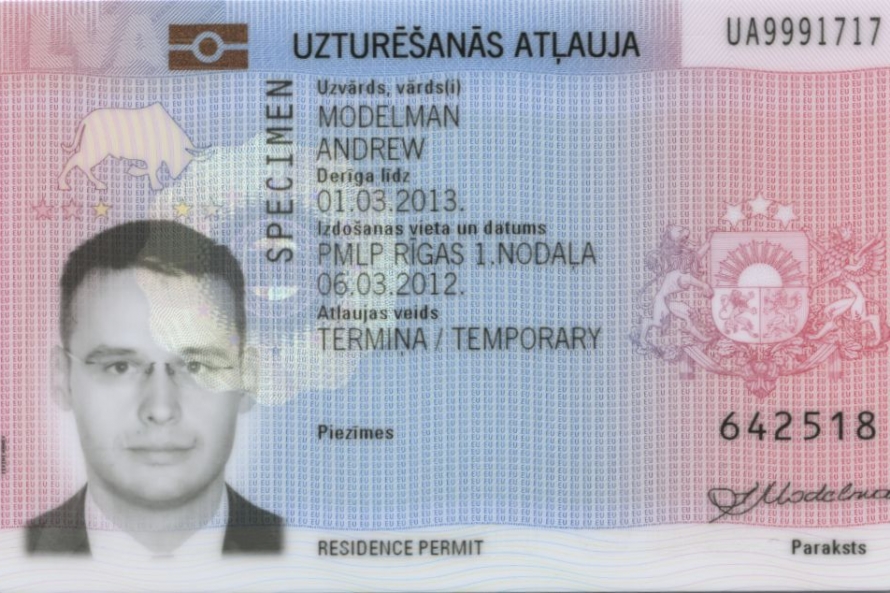

Russia’s investors are mostly interested in the real estate markets of Riga and Jurmala, explained the representative from „Lursoft”, which serves Latvia’s Enterprise Registry as its cooperation partner for information technology. She added that the primary motivation for this type of investor is to acquire residency permits here, thus ensuring access to the visa-free Schengen Zone states of the EU. Compared to 2751 residency permits issued to Russian real estate investors, only 458 such permits were issued to investors from Russia who actually bought shares in Latvian corporate entities.

The appearance of Ukraine as the fifth-largest source of foreign investors here is attributed more to the internal economic insecurity in the home country, which has caused them to seek relatively safe harbors for their capital in other nearby states.

However, the effects of tensions between Ukraine and Russia have also likely caused larger global investors to become extremely cautious in their considerations toward any country in their neighboring vicinities.