First, here is a quick recap of the new system:

Incomes below 510 EUR per month are not taxed (this is the non-taxed minimum).

Incomes between 510 EUR and 8775 EUR per month will be taxed at a 25.5% rate.

Incomes above 8775 EUR per month will be taxed at a 33% rate.

We often think of a good tax system as one that is fair (biggest burdens to be borne by the broadest shoulders, i.e. more taxes, both in EUR terms as well as a share of income, to be paid by higher incomes) and reasonably simple.

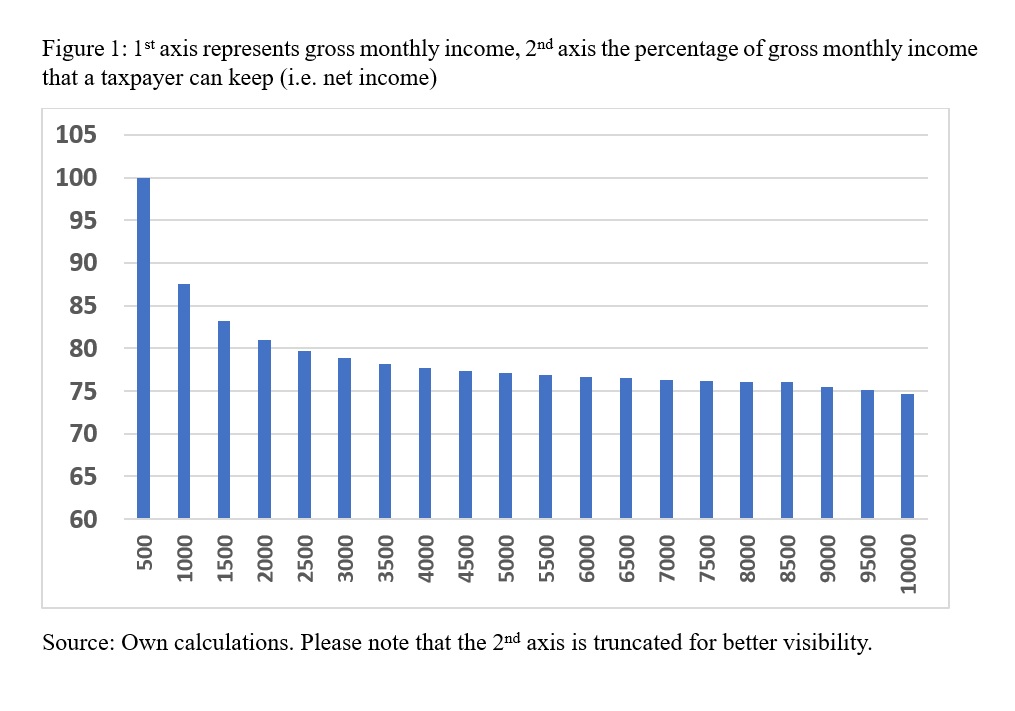

The 2025 proposal does fulfil the first part – higher incomes will pay more tax in terms of EUR as well as a share of their incomes (whether they pay enough is another and more personal as well as political matter). Figure 1 below shows how much of one’s gross income one can keep after taxes are paid (excluding social taxes). As can be seen, that share decreases with higher

gross income, although quite slowly at incomes higher than 3000 EUR per month.

I also find that the new structure is a simplification. It is important that one’s tax burden is reasonably simple to calculate and it will certainly become simpler now. The existing system, with rates of 20%, 23% and 31% was more complicated – particularly so due to the reduction of the non-taxed minimum as incomes grew higher. Now, the non-taxed minimum is for everyone, no matter what the gross salary is – a clear simplification.

It is set to rise in the coming years (510 EUR per month in 2025, 550 EUR in 2026, 570 EUR in 2027). This benefits all taxpayers but is relatively most important for the low-income earners. The main drawback is that it is very expensive in terms of lost revenue. A 40 EUR increase from 2025 to 2026 does not sound like much; it will imply a loss of revenue of just over 10 EUR per month per taxpayer but with about 700,000 taxpayers earning at least 550 EUR, it amounts to about 7 million EUR per month or 84 million EUR per year.

The oddity for me is the 33% rate. Not that I am particularly against it, but since it applies only to incomes above 8775 EUR per month, we are talking about some REALLY broad shoulders... and not very many of them.

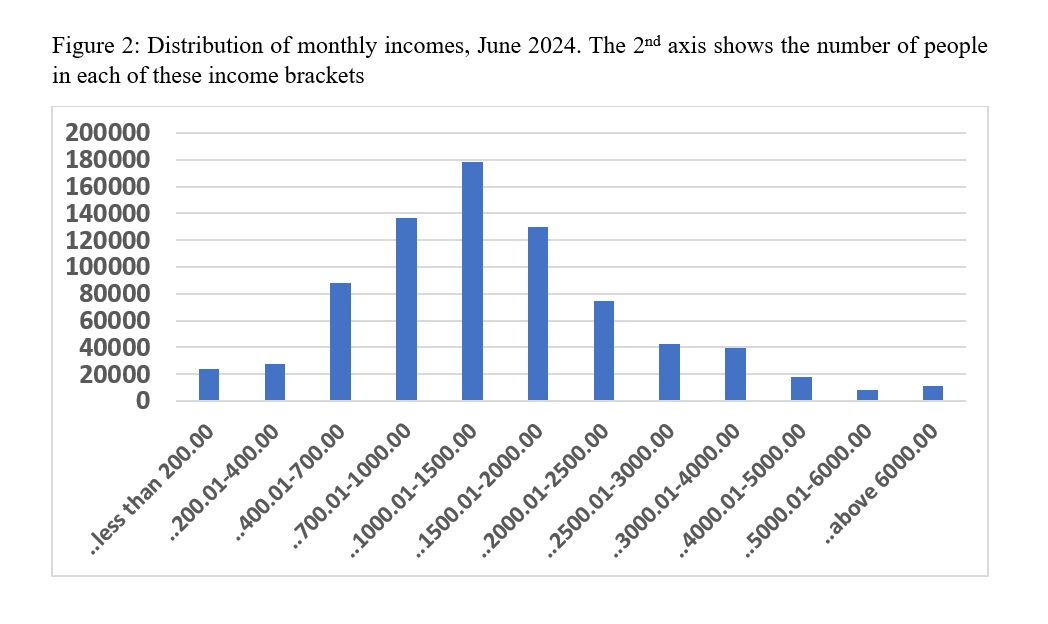

I cannot find the exact number of income earners with more than 8775 EUR per month; the closest I can get from the Statistics Portal of Latvia is presented in Figure 2 and shows that, currently (June 2024), 11,355 persons earn more than 6000 EUR per month.

The number of persons earning above 8775 EUR a month is thus lower and most likely considerably lower. A higher tax rate is applied to those few people but it is not an overwhelming revenue machine when it targets so very few individuals. In short, if one wants a degree of progressivity in the tax system, why not let this rate kick in at a substantially lower level of monthly income?

Source: Official Statistics Portal of Latvia

So, overall I find the 2025 system better than the existing one: reasonably fair although one may agree or disagree about whether it is fair enough. And certainly a simplification.

But the change in terms of social taxes, shifting one percentage point from the 2nd pillar pension to the 1st pillar was not a smart move. It may be just for a few years but it has opened Pandora’s Box – if it can be done now, it can be done again. This causes uncertainty and that is not what is needed for something that reaches so far into the future as a pension system does.

It might even drive more people into the grey economy since one will save less for one’s own pension.