The International Monetary Fund (IMF) provides macroeconomic statistics on 196 countries and among this data is government revenue, which does not perfectly reflect tax revenue or tax burden (some government revenue might e.g. come from state-owned companies) but in the case of Latvia and almost all other countries in this article it is close enough.

Of those 196 countries, Latvia has the 56th highest government revenue, standing in 2022 at 36.5% of the country’s GDP, putting the country almost in the top-25% in the world (Estonia is number 49 and Lithuania is at position 58). Proof that taxes in Latvia are high, some would say, but I shall argue otherwise.

At the bottom of this ranking, with government revenue at only 6-7% of GDP we find countries like Venezuela, Haiti, Lebanon and Somalia – failed states unable to have a minimally functioning tax system and hardly countries that most of us would dream of living in.

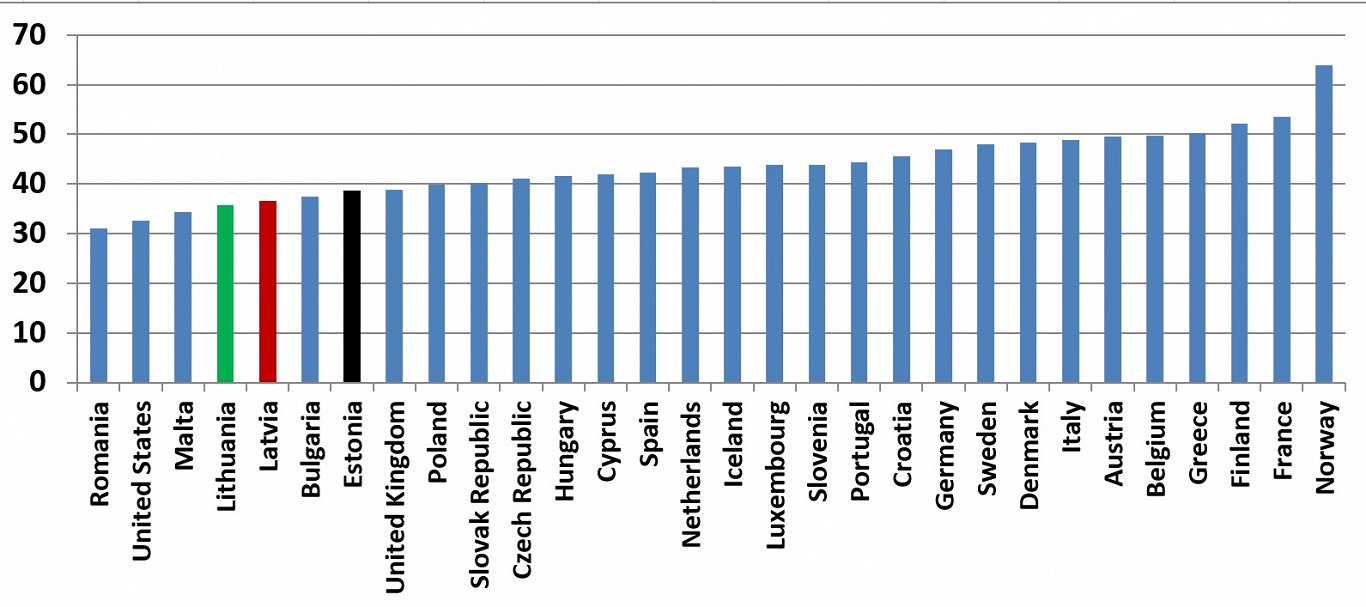

It is when Latvia is compared to countries similar to itself that the relatively low tax burden appears. In Figure 1 I present data from 2022 (the most recent completed year) for the EU countries with Norway and Iceland added (to have all the Nordic countries represented) as well as the UK and USA.

Figure 1: Government revenue as share of GDP, 2022. EU27 minus Ireland, plus Norway, Iceland, UK, USA. (Note: Ireland is excluded since its GDP data is distorted)

The USA is famously/infamously a very rich country but with a relatively small tax take, but the EU country Romania has an even smaller share of tax to GDP. Norway’s very high share is distorted by very large state revenues from its oil and gas sector but otherwise we find that the government tax burden is highest in Western Europe while the Eastern European countries typically have significantly smaller tax burdens, including Latvia’s 36.5% of GDP, which is only higher in the EU than in Lithuania, Malta and Romania. Among its peers, Latvia is a low-tax country – like it or not.

Former Estonian Prime Minister Taavi Roivas once described the Baltic countries as the “New Nordics”. Not, as one can see, in terms of taxation. There, the Baltic countries are better described as Anglo-Saxon type economies with low tax burdens similar to those in the UK and the USA.

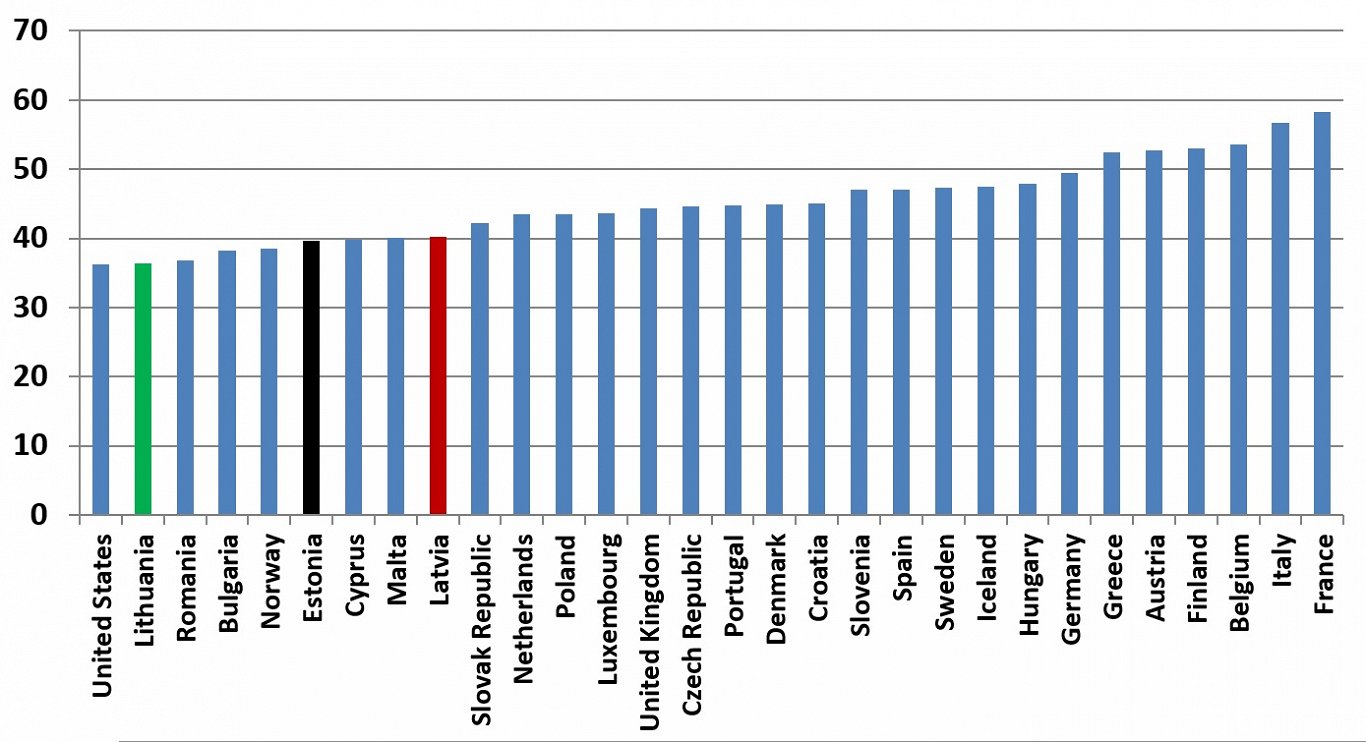

The flip side of this relatively low tax burden is of course the relatively small public sector that comes with it. Figure 2 is very similar to Figure 1 – the same countries appear but this time with total public sector expenditure as a share of GDP.

Figure 2: Government expenditure as share of GDP, 2022. EU27 minus Ireland, plus Norway, Iceland, UK, USA. (Note: Ireland is excluded since its GDP data is distorted)

The correlation between the two graphs is very high; high-tax countries typically have bigger welfare states. Latvia is a relatively low-tax country (Figure 1) but also a country with a relatively small welfare state (Figure 2).

Only those lucky Norwegians can have their cake and eat it but before one starts dreaming of a potential oil-and-gas adventure in Latvia, please think of how many countries have squandered this possibility: Venezuela, Nigeria, Russia etc.

Rather, keeping one’s feet solidly on the ground, it is interesting to speculate about the future of the Latvian economy in this context. Will it aim at being more Nordic with a more comprehensive welfare state? If so, the tax burden will have to increase. Or will the country continue to be more of the Anglo-Saxon type?

Going back to the beginning of this article, the latter is obviously the case for now but who knows about 20-50 years from now?

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga and former Vice-Chairman of the Fiscal Discipline Council of Latvia.