The largest part, or about 80%, of the public purse is made up of tax revenues. So theoretically it should be that the higher the taxes, the more money is available in the public purse. That begs the question: how is it that with the highest tax burden in the Baltics we are still the poorest for welfare spending.

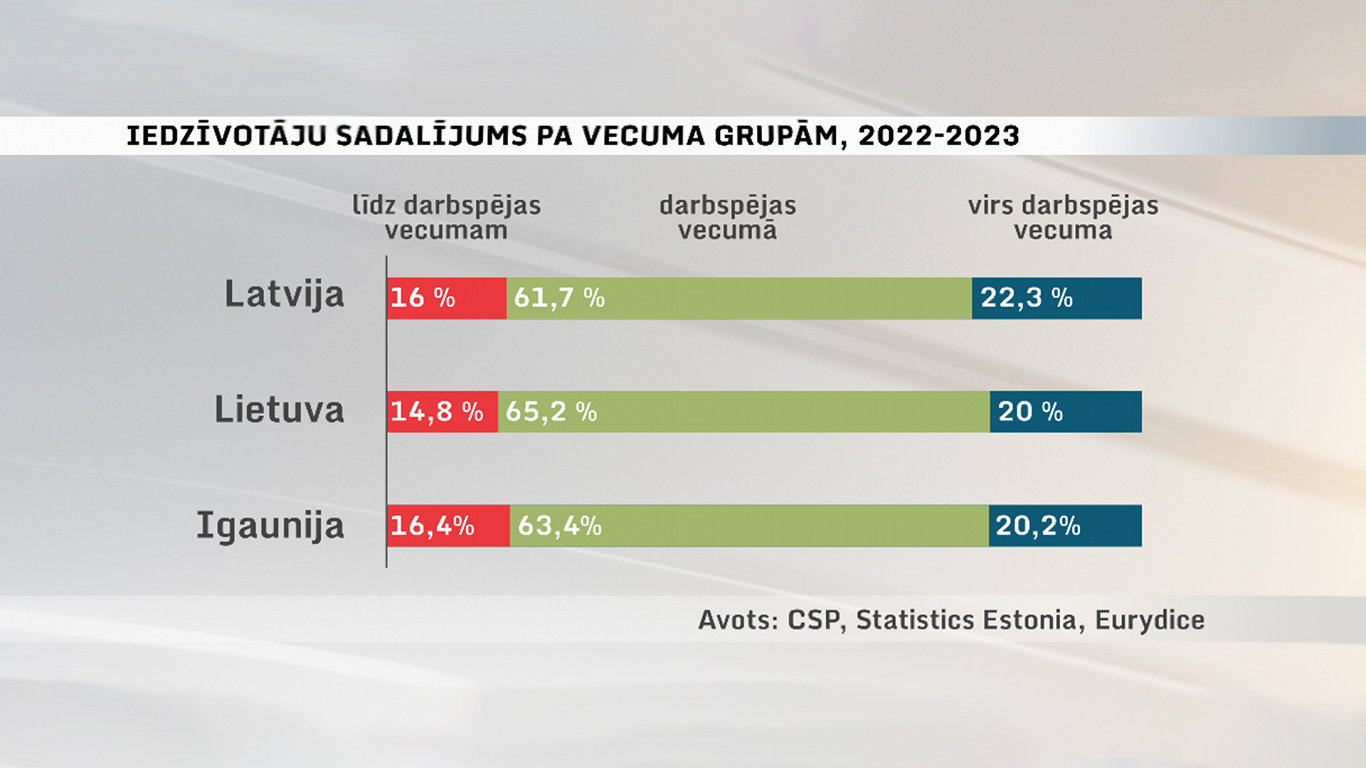

An important factor is, of course, the number of people in the workforce and their competitiveness. And this is where the first significant problem emerges – the employment level in Latvia is 2 percentage points lower than in Lithuania and 5 percentage points lower than in Estonia. This, in turn, reflects higher unemployment and lower participation of citizens in the labor market, as well as a smaller share of the population of working age.

% of population of working age (green), pre-working age (red), post-working age (blue)

Director of the Department of Social Statistics of the Central Statistical Office, Baiba Zukula, explained that there was "a low birth rate in the nineties, at the beginning of the 2000s, as a result, fewer people reach working age, the second reason is migration - the population of working age basically participates in migration. This means both departures and arrivals."

Last year, the general government budget in Latvia was 15.7 billion euros, in Estonia it was 14.3 billion euros, and in Lithuania it was 24.5 billion euros. But it's worth bearing in mind that the population of Latvia is 1.9 million, while Estonia has 1.3 million and Lithuania 2.8 million inhabitants. With fewer inhabitants than Lithuania, but considerably more inhabitants than Estonia, Latvia collects less from the public purse than both neighboring countries.

General state budgets of Baltic states

However, it is important to point out here that the general government budget is after the single adjustment of the European Union. The budget before this adjustment is called the consolidated state budget. By this measure Latvia comes in at 10.7 billion euros, Lithuania at 15.1 billion euros and Estonia at 13.1 billion euros.

Baltic consolidated state budgets, 2022

With fewer inhabitants than Lithuania, but considerably more inhabitants than Estonia, Latvia collects less from the public purse than both neighboring countries. This trend has been repeating itself for years.

Gundars Bērziņš, dean of the Faculty of Business Management and Economics of the University of Latvia, professor and leading researcher, explained: "So our economy is small, and also the fact that we take a percentage of this economy or of GDP, as we usually say, which characterizes the size of the economy, a relatively small part. This small part also makes up our budget."

"Actually, the size of our economy is too small compared to the population to satisfy all the needs that, in our opinion, such a country should satisfy. Specifically in the social field, in the various services provided by the state," said Bērziņš.

Luminor bank economist Pēteris Strautiņš said that "there are all kinds of nuances regarding the tax collection process. It is important not only how big the taxes are, but also how much time it takes, purely administratively... taxes is one of those areas that could definitely benefit from simplifying processes using modern technology."

The chief economist of the Bank of Latvia, Baiba Brusbārde, pointed out another aspect for consideration. "One is the size of the shadow economy. Because we have a large shadow economy, the group of people or companies from which we can collect taxes is smaller. If we have 10 people who pay a salary of 1,000 euros, in Estonia it is 20 people who pay, therefore again at the same salary, at the same rate, Estonian income will be higher, because simply their shadow economy is smaller".

LTV News will cover this theme in future stories, too.