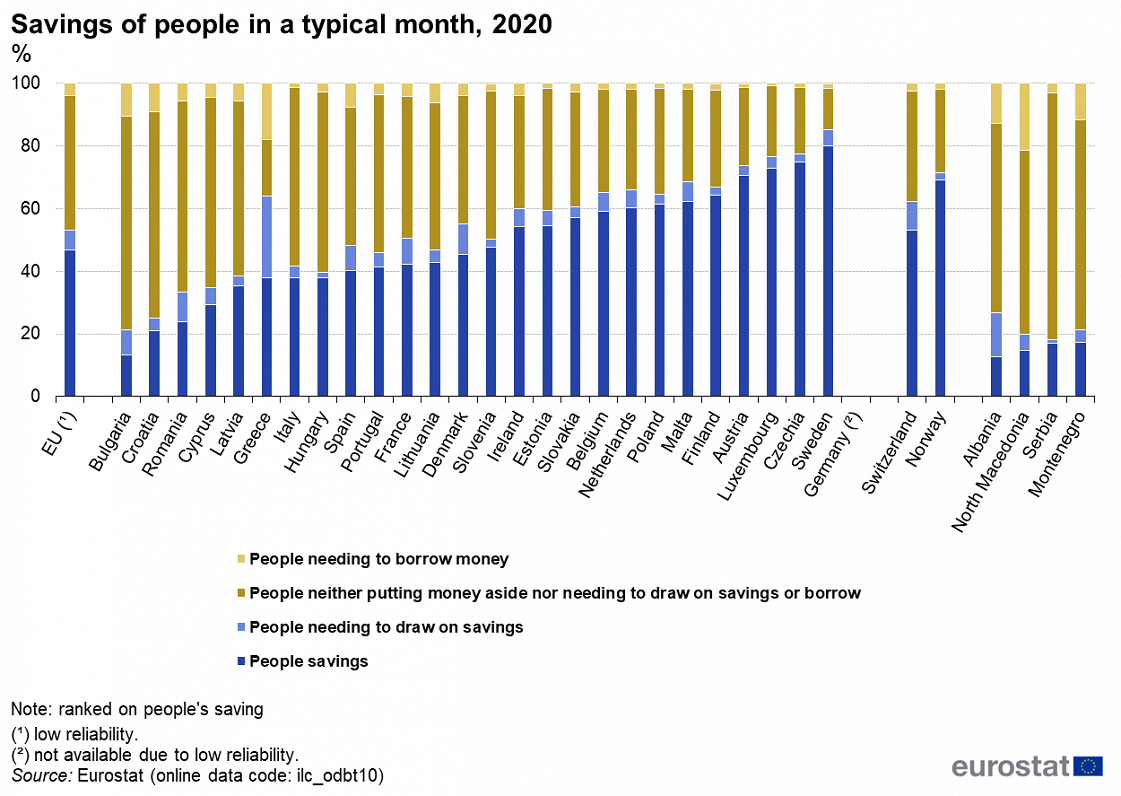

In 2020, most people in the EU were, in a typical month, able to either save money (46.9 %) or to make ends meet (not saving but not drawing on savings or borrowing) (42.9 %). Only 6.3 % and 3.9% of people were obliged to use their savings or to borrow, respectively.

In 2020, at national level, the proportion of people able to save money in a typical month varied across EU countries. The share of people with the highest level of ability to save in a typical month was recorded in Sweden (80.2 %), followed by Czechia (75.0 %), Luxembourg (72.9 %), Austria (70.6 %), Finland (64.4 %), Malta (62.2 %), Poland (61.5 %) and the Netherlands (60.4 %).

On the other hand, the share of people with the lowest level of ability to save was recorded in Bulgaria (13.3 %), Croatia (21.0 %), Romania (23.8 %), Cyprus (29.4 %) and Latvia (35.5%).

In addition, 6.3 % of people in the EU needed to use their savings to cover their daily living expenses in a typical month. The countries with the highest shares of the population using their savings to pay for living expenses were Greece (26.2 %), Romania and Denmark (both with a share of 9.7 %), and France (8.3 %), while the lowest share was reported in Hungary (1.8 %).

Furthermore, 3.9 % of people in the EU borrowed money to cover their daily living expenses. Greece had the highest share of people borrowing (17.8 %), followed by Bulgaria (10.6 %) and Croatia (9.0 %), while the lowest shares were observed in Luxembourg (0.8 %), Italy (1.2 %), Austria (1.3 %) and Czechia (1.4 %). For Latvia the figure was 5.5%.