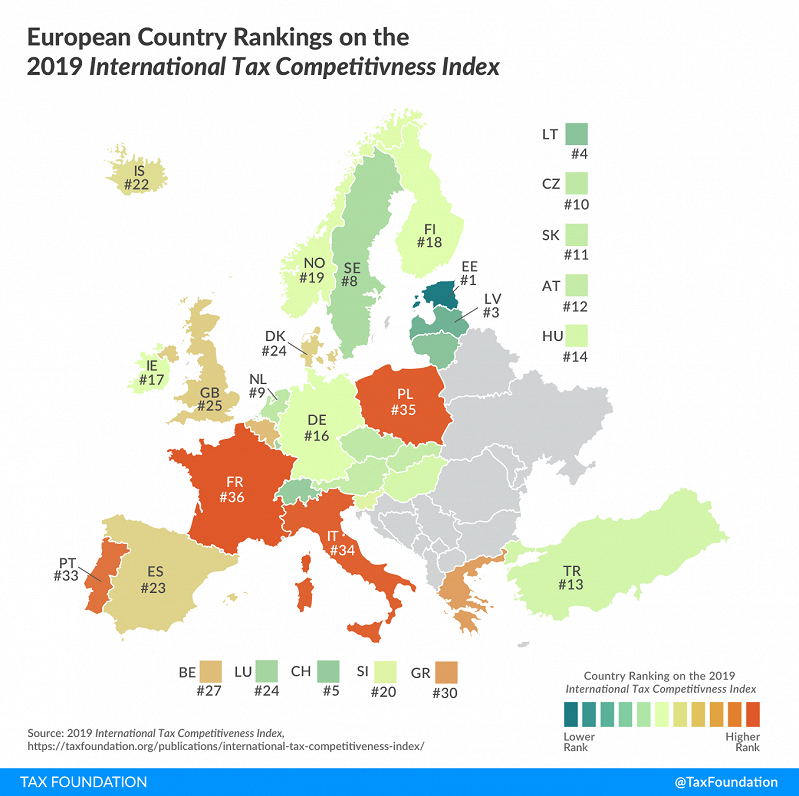

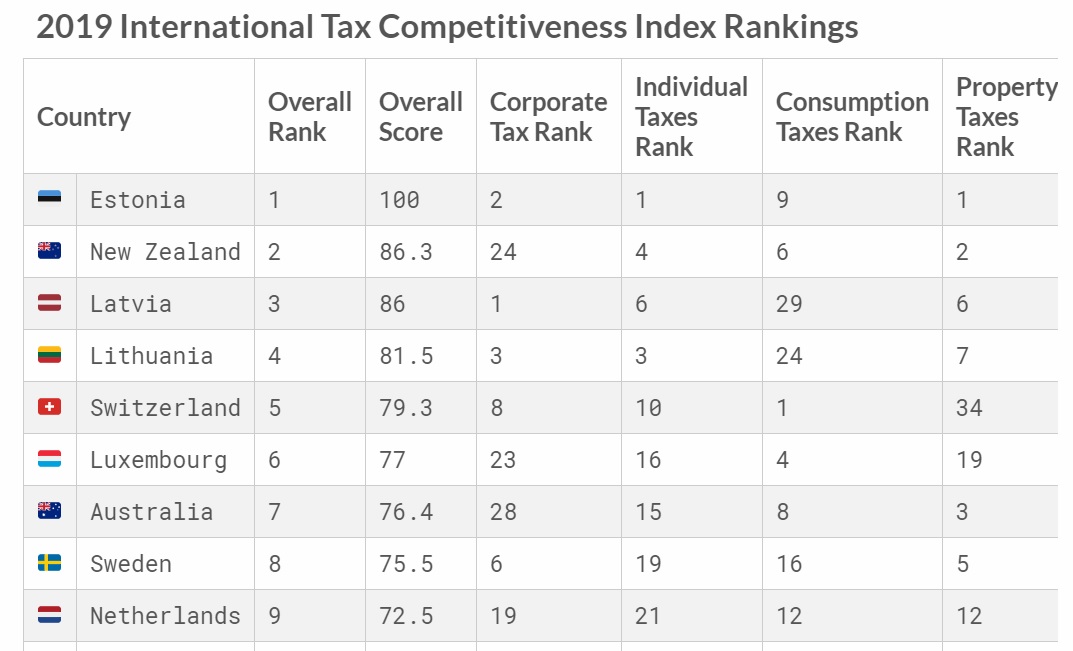

The Tax Foundation’s International Tax Competitiveness Index (ITCI) measures the degree to which the 36 Organizaion for Economic Cooperation and Development (OECD) countries’ tax systems promote competitiveness through low tax burdens on business investment and neutrality through a well-structured tax code. The ITCI considers more than 40 variables across five categories: Corporate Taxes, Individual Taxes, Consumption Taxes, Property Taxes, and International Tax Rules.

Latvia emerges in third place overall, behind Estonia in first place and New Zealand in second place. Baltic neighbor Lithuania is in fourth and Switzerland - a country that conjures up immediate associations with tax systems - in fifth. For the sixth year in a row, Estonia has the best tax code in the OECD.

On corporate taxes, Latvia actually ranks first.

"Latvia's corporate income tax system only taxes distributed earnings, allowing companies to reinvest their profits tax-free," says the Tax Foundation, adding that "Latvia's taxes on labor are relatively flat, allowing the government to raise revenue from taxes on workers with very few distortions."

However, on consumption taxes it is in a lowly 29th place.

"The threshold at which the VAT applies is nearly twice as high as the average VAT threshold for OECD countries," says the Tax Foundation.

In last year's equivalent report, Latvia was ranked second behind Estonia, as reported by LSM at the time.

You can explore the data at the dedicated website.

The Tax Foundation is an American independent tax policy non-profit organization.

2019 International Tax Competitiveness Index:

— Tax Foundation (@taxfoundation) October 2, 2019

??1

??2

??3

??4

??5

??6

??7

??8

??9

??10

??11

??12

??13

??14

??15

??16

??17

??18

??19

??20

??21

??22

??23

??24

??25

??26

??27

??28

??29

??30

??31

??32

??33

??34

??35

??36

See more: https://t.co/wfZbFWzsVf@danieldbunn @ElkeAsen pic.twitter.com/maDsNRvpBD