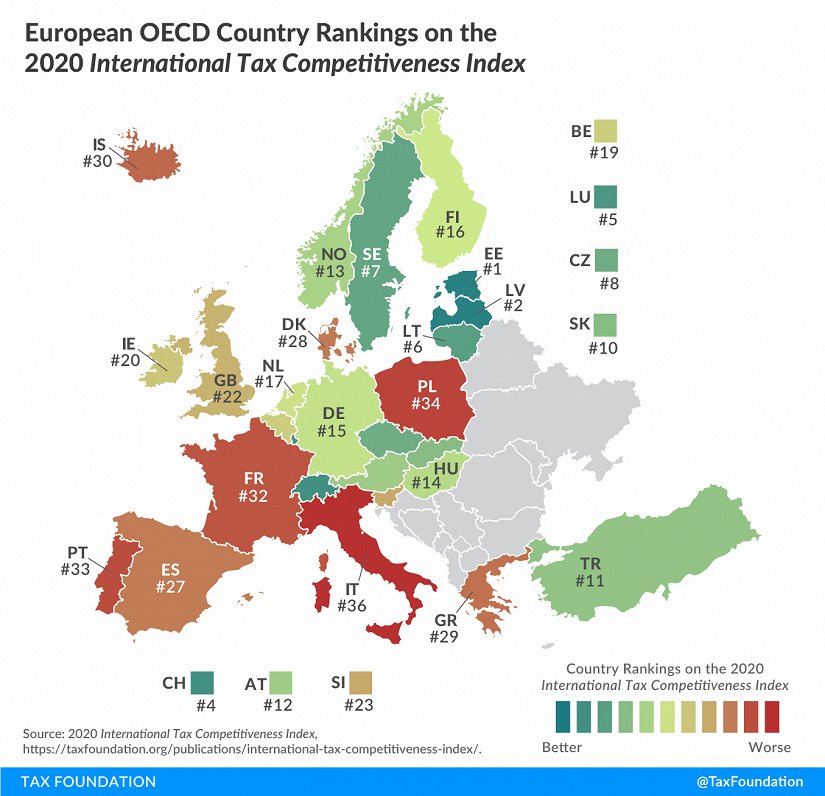

The US-based Tax Foundation (TF) released its annual International Tax Competitiveness Index on October 14, placing Latvia second behind Estonia.

In its accompanying report, TF said:

"While Estonia’s tax system is the most competitive in the OECD, the other top countries’ tax systems receive high scores due to excellence in one or more of the major tax categories. Latvia, which recently adopted the Estonian system for corporate taxation, also has a relatively efficient system for taxing labor income. New Zealand has a relatively flat, lowrate individual income tax that also exempts capital gains (with a combined top rate of 33 percent), a well-structured property tax, and a broad-based value-added tax."

According to TF, its methodology measures the degree to which the Organizaion for Economic Cooperation and Development (OECD) countries’ tax systems promote competitiveness through low tax burdens on business investment and neutrality through a well-structured tax code. It considers more than 40 variables across five categories: Corporate Taxes, Individual Taxes, Consumption Taxes, Property Taxes, and International Tax Rules.

As previously reported by LSM, in 2019 Latvia ranked third, and in 2018 it was second. On each occasion, Estonia maintained top spot.

The Tax Foundation is an American independent tax policy non-profit organization.