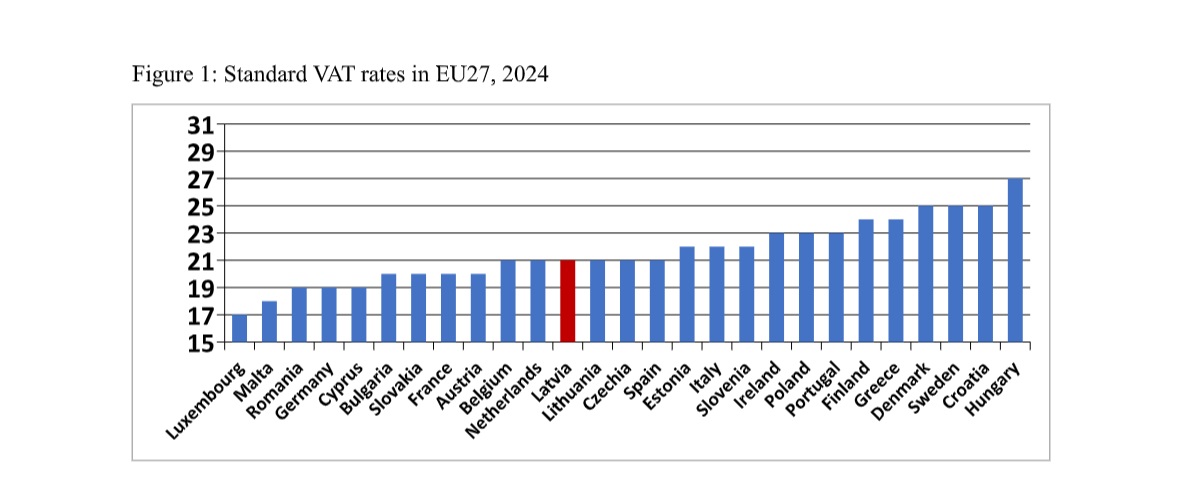

The standard VAT rate in Latvia is 21%, which puts the country in the middle ground in the EU (see Figure 1). It is the same rate as in Lithuania and one percentage point lower than in Estonia. Many countries, including Latvia, also apply reduced VAT rates on some products (in Latvia it is 12% on goods such as some medicines, locally-grown fruits and berries and 5% on newspapers). A comprehensive list for all EU countries can be found here.

Figure 1: Standard VAT rates in EU27

VAT contributed 3.9 billion euros to the state budget in 2023, some 29% of total tax revenue, making it the second-most-important tax revenue item (behind social taxes but ahead of personal income taxes).

An increase from 21% to 22% could increase budget revenues by some 150-200 million euros (a back- of-the-envelope calculation by me; I am sure Ministry of Finance officials can make a better estimate); a substantial amount with the country facing increased spending needs for defense, health etc.

Some arguments in favor of a higher VAT rate:

1) VAT is a very broad measure in the sense that just about everybody pays it. If I buy an ice cream, I contribute VAT income to the state but so does a 10-year old kid buying an ice cream. On the one hand there is an element of fairness in this – we all benefit from better defense and health spending so we should all contribute. On the other hand, the broadness of the measure implies that each one of us does not have to contribute so much. Many small contributions still add up to several billions. Income tax, for instance is paid by less than half of the population for the simple reason that less than half of the population works.

2) Latvia needs, on a permanent basis, more spending for defense, health and possibly other areas. A permanent increase in the VAT rate is a good suggestion to meet such demands.

3) Higher income households tend to spend more than lower income households and will thus also pay more VAT in absolute terms, i.e. in terms of euros. Also here, a fairness argument applies – broader shoulders should bear a bigger burden.

Some arguments against a higher VAT rate

4) … but the lower incomes will tend to pay a higher relative share of their incomes in VAT since they typically spend all or close to all of their income while higher income households are likely to save some. This makes VAT a so-called regressive tax, one that burdens the lower incomes the most.

5) It will increase inflation (a bit) since higher a VAT rate will be added to prices. This is always unpopular but especially now, after a period of very high inflation in 2022.

6) In and by itself it will lower economic growth as more of our income will be needed for the same amount of purchases. Using the VAT revenue for defense and health will, however, boost economic growth.

7) It may be a minimal change, 21 to 22, but it will certainly not encourage firms in the gray economy to become legitimate. If anything, it could increase the grey economy instead.

8) VAT is a broad tool but also a blunt one. With income taxes, one can easily make higher incomes pay a higher share of taxes, in Latvia via the progressive tax rates of 20%, 23% and 31.4%. Differentiated VAT rates cannot be applied, however. We all pay the same VAT rate for a certain product.

9) And it is a measure that eventually becomes exhausted. Can we imagine, some day, a VAT rate of 100%? I think not. But the EU data show that a higher VAT rate here is still highly feasible.

I have provided more arguments against higher VAT than arguments in favor of higher VAT but that is not to say that the verdict is necessarily against. Applying VAT in a modern economy is a normal and necessary tool for obtaining a reasonable amount of tax revenue, in particular due to its broadness. Alas, the eventual solution is a political one, which is happily out of my hands.

A last comment, however, should be that a vast untapped source of tax revenue remains out there: the gray economy. It is sad, counterproductive and simply unfair to those who do pay taxes that it is still so vast, now, 30+ years after regaining independence.

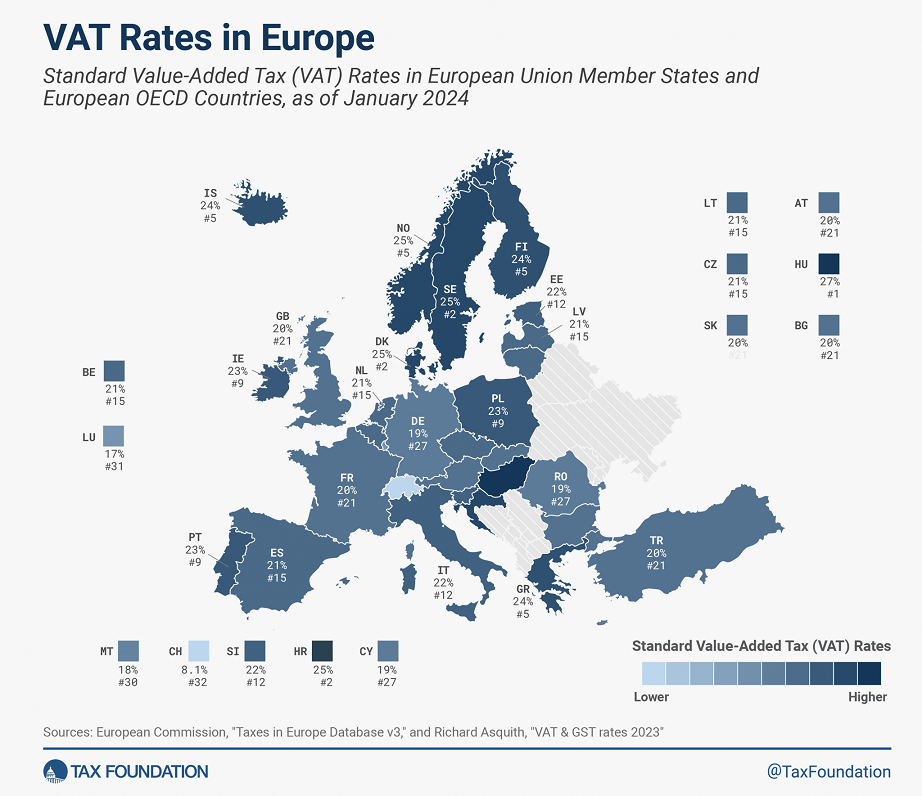

Source: Tax Foundation

Morten Hansen is Head of Economics Department at Stockholm School of Economics in Riga

and former Vice-Chairman at the Fiscal Discipline Council of Latvia